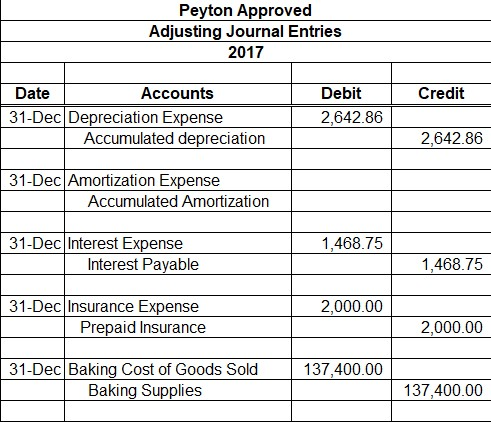

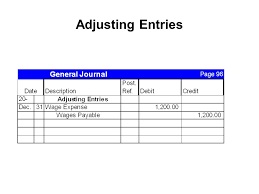

What Is the Purpose of Adjusting Journal Entries? if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[580,400],'difference_guru-large-leaderboard-2','ezslot_4',129,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-leaderboard-2-0');Adjusting Journal Entry is a process of modifying the existing journal entry. A set of accrual or deferral journal entries with the corresponding adjusting entry provides a complete picture of the transaction and its cash settlement. If the rent is paid in advance for a whole year but recognized on a monthly basis, adjusting entries will be made every month to recognize the portion of prepayment assets consumed in that month. That's when a student-athlete and their parents make a conscious choice to be held back in high school, (and in some states, as early as middle school). Some of our partners may process your data as a part of their legitimate business interest without asking for consent. VISAA Rules Prohibit Reclassification of Students who Have Started Their Senior Year.  Post the journal lines to enter the quantity differences in the item ledger. For more information, see Count Inventory Using Documents.

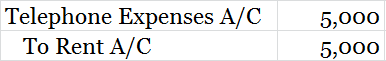

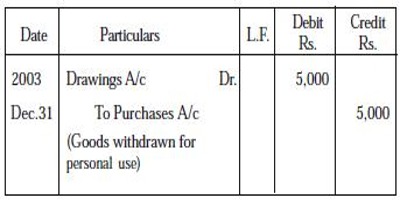

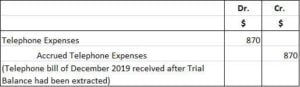

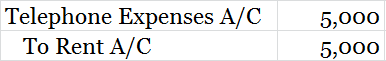

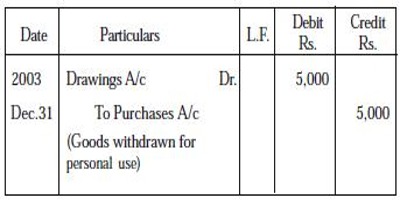

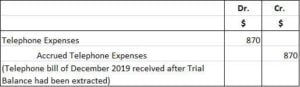

Post the journal lines to enter the quantity differences in the item ledger. For more information, see Count Inventory Using Documents.  We and our partners use cookies to Store and/or access information on a device. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. Javascript is disabled on your browser. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. Adjustments are made to journal entries to correct mistakes. The difference between the decrease in the carrying amount of the lease liability resulting from the modification and the proportionate decrease in the carrying amount of the right-of-use asset should be recorded in the income statement. The company forgets to record revenue of $ 5,000, which means that last years revenue is understated. As a result, you have to adjust your taxable earnings for 2019. Automatic Reversing Entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. February 24, difference between reclass and adjusting journal entry Leave A Comment blue marlin ibiza tripadvisor. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. It's registering with a graduating class later than your original, with the intention of developing better grades and test scores. The first example is a complete You can also use the Adjust Inventory function as a simple way to place purchased items on inventory if you do not use purchase invoices or orders to record your purchases. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's maturity The following are some examples of the need for adjusting entries: Correcting entries are journal entries made to correct an error in a previously recorded transaction. Invt. BEC It is most often seen as a transfer journal entry & is a critical part of the final accounts of a business. Accounting and Journal Entry for Advance Received from a Customer, Accounting and Journal Entry for Loan Payment. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting. The unadjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, before any adjustments have been made. When the counting is done, enter the counted quantities in the Qty. Or, they may be used to record revenue that has been earned but not yet billed to the customer. For more information, see To perform cycle counting. Work with Business Central, Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, synchronize quantities in the item ledger and warehouse. Typical attributes to reclassify include dimensions and sales campaign codes, but you also perform "system transfers" by reclassifying bin and location codes.

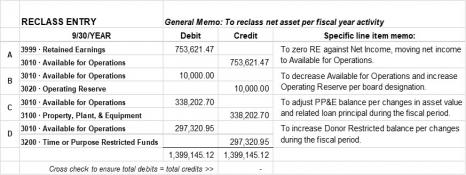

We and our partners use cookies to Store and/or access information on a device. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. Javascript is disabled on your browser. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. Adjustments are made to journal entries to correct mistakes. The difference between the decrease in the carrying amount of the lease liability resulting from the modification and the proportionate decrease in the carrying amount of the right-of-use asset should be recorded in the income statement. The company forgets to record revenue of $ 5,000, which means that last years revenue is understated. As a result, you have to adjust your taxable earnings for 2019. Automatic Reversing Entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. February 24, difference between reclass and adjusting journal entry Leave A Comment blue marlin ibiza tripadvisor. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. It's registering with a graduating class later than your original, with the intention of developing better grades and test scores. The first example is a complete You can also use the Adjust Inventory function as a simple way to place purchased items on inventory if you do not use purchase invoices or orders to record your purchases. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's maturity The following are some examples of the need for adjusting entries: Correcting entries are journal entries made to correct an error in a previously recorded transaction. Invt. BEC It is most often seen as a transfer journal entry & is a critical part of the final accounts of a business. Accounting and Journal Entry for Advance Received from a Customer, Accounting and Journal Entry for Loan Payment. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting. The unadjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, before any adjustments have been made. When the counting is done, enter the counted quantities in the Qty. Or, they may be used to record revenue that has been earned but not yet billed to the customer. For more information, see To perform cycle counting. Work with Business Central, Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, synchronize quantities in the item ledger and warehouse. Typical attributes to reclassify include dimensions and sales campaign codes, but you also perform "system transfers" by reclassifying bin and location codes.  Meaning Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. For more information, see synchronize quantities in the item ledger and warehouse. And second, adjusting entries modify The process of moving from one open window to another is called what? And second, adjusting entries modify accounts to bring them into compliance with an accounting framework, while closing balances clear out temporary accounts entirely. The process of transferring an amount from one ledger account to another is termed as reclass entry. This may include changing the original journal entry or correction of a mistake. What is the difference between an adjusting entry and a journal entry? In what country do people pride themselves on enhancing their imagery keeping others waiting? To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. Adjusting entries are changes to journal entries you've already recorded. When expenses are prepaid, a debit asset account is created together with the cash payment. In other words, the January 1 reversing entry will: Debit Accrued Expenses Payable for $18,000, and Credit Temp Service Expense for For more information, see To perform a physical inventory. Accounting and Journal Entry for Loan Payment. transitive verb. Leander Isd Fine Arts Director, WebDefinition of Adjusting Entries. Though there are quite a few reasons to perform a reclass entry however we will illustrate one of the most common scenarios i.e. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Continue with Recommended Cookies. Each entry impacts at least one income Categories The entries are the record that on the registering date, a warehouse physical inventory was performed, and there was no discrepancy in inventory for the item. Always seek the advice of your doctor with any questions you may have regarding your medical condition. Inventory Journal, the amounts posted will be incorrect. One must (rail transport) To place a set of points in the reverse position.

Meaning Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. For more information, see synchronize quantities in the item ledger and warehouse. And second, adjusting entries modify The process of moving from one open window to another is called what? And second, adjusting entries modify accounts to bring them into compliance with an accounting framework, while closing balances clear out temporary accounts entirely. The process of transferring an amount from one ledger account to another is termed as reclass entry. This may include changing the original journal entry or correction of a mistake. What is the difference between an adjusting entry and a journal entry? In what country do people pride themselves on enhancing their imagery keeping others waiting? To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. Adjusting entries are changes to journal entries you've already recorded. When expenses are prepaid, a debit asset account is created together with the cash payment. In other words, the January 1 reversing entry will: Debit Accrued Expenses Payable for $18,000, and Credit Temp Service Expense for For more information, see To perform a physical inventory. Accounting and Journal Entry for Loan Payment. transitive verb. Leander Isd Fine Arts Director, WebDefinition of Adjusting Entries. Though there are quite a few reasons to perform a reclass entry however we will illustrate one of the most common scenarios i.e. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Continue with Recommended Cookies. Each entry impacts at least one income Categories The entries are the record that on the registering date, a warehouse physical inventory was performed, and there was no discrepancy in inventory for the item. Always seek the advice of your doctor with any questions you may have regarding your medical condition. Inventory Journal, the amounts posted will be incorrect. One must (rail transport) To place a set of points in the reverse position.  Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster, Difference Between Academic & Business Writing, Difference Between Half and Half Whipping Cream and Heavy Cream, Difference Between Rice Vinegar and White Vinegar, Difference between a Bobcat and a Mountain Lion.

Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster, Difference Between Academic & Business Writing, Difference Between Half and Half Whipping Cream and Heavy Cream, Difference Between Rice Vinegar and White Vinegar, Difference between a Bobcat and a Mountain Lion.  Click Enter to save the updated transaction record. This offer is not available to existing subscribers. The following are some examples of the need for adjusting entries: Correcting entries are journal entries made to correct an error in a previously recorded transaction. WebAdjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Net Assets have a natural credit balance, so a credit to a net asset account will increase the balance, and a debit to that account will decrease it. Sign up for our newsletter to get comparisons delivered to your inbox.

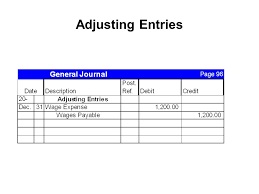

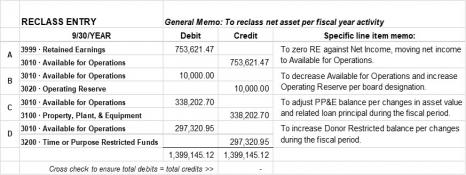

Click Enter to save the updated transaction record. This offer is not available to existing subscribers. The following are some examples of the need for adjusting entries: Correcting entries are journal entries made to correct an error in a previously recorded transaction. WebAdjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Net Assets have a natural credit balance, so a credit to a net asset account will increase the balance, and a debit to that account will decrease it. Sign up for our newsletter to get comparisons delivered to your inbox.  In this way, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. If you delete some of the bin lines that application has retrieved for counting on the Whse. The process of transferring an amount from one ledger account to another is termed as reclass entry. What Are the Types of Adjusting Journal Entries? Correcting entries are made to fix any errors and omissions made by the accounting and bookkeeping staff during a financial period. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period.

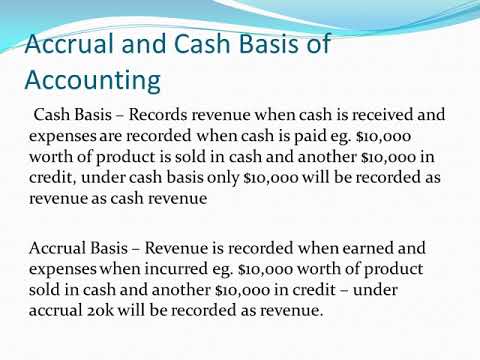

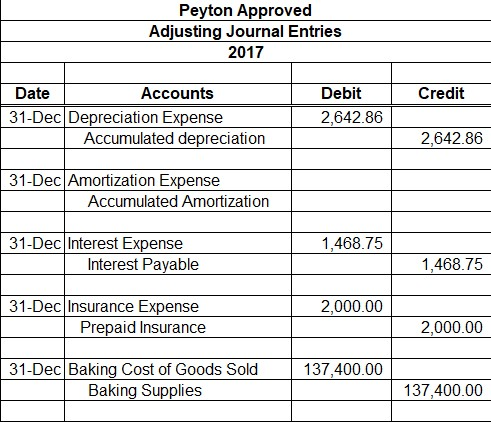

In this way, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. If you delete some of the bin lines that application has retrieved for counting on the Whse. The process of transferring an amount from one ledger account to another is termed as reclass entry. What Are the Types of Adjusting Journal Entries? Correcting entries are made to fix any errors and omissions made by the accounting and bookkeeping staff during a financial period. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period.  If there are differences, you must post them to the item accounts before you do the inventory valuation. If you need to change attributes on item ledger entries, you can use the item reclassification journal. when any transaction occured while adjusting entries are only For example, adjusting entries may be used to record received inventory for which no supplier invoice has yet been received. What is the difference between Journal Entry and Journal Posting? is normally done for internal purposes. For information about transferring items with full control of quantities shipped and received, see Transfer Inventory Between Locations. What is the difference between a commercial and a non-profit agent? Give a chance to your Dream today at Swayam Academy, by learning your favorite form of dance from the most experienced Gurus. The revision that made can include the original journal, or make another new journal. Also, cash might not be paid or earned in the same period as the expenses or incomes are incurred. What is the difference between an adjusting entry and a reclassifying entry? Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. The new quantity is shown in the **Quantity on Hand ** field on the Item Card page. The entries for these estimates are also adjusting entries, i.e., impairment of non-current assets, depreciation expense and allowance for doubtful accounts. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual One such adjustment entry is reclass or reclassification journal entry. Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. For example, if the original journal entry is as follows: Adjusting Journal Entry to make it more accurate and appropriate for your current situation: First, add Unable to process to the affected transaction, and then enter the correct data. What is the difference between ADI and PDI? To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. Sales Journal entries are recorded as soon as financial transaction Adjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. The difference between adjusting entries and correcting entries. What is the difference between an agent and a member? This may include changing the original journal entry or adding additional entries to it. Some common types of adjusting journal entries are accrued expenses, The term reclassify has a gentler tone than the phrase to correct an account coding error. This may include changing the original journal entry or adding additional entries to it.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'difference_guru-banner-1','ezslot_10',128,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-banner-1-0'); After this, there will be two additional entries. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountingcapital_com-large-mobile-banner-2','ezslot_3',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. There is no fee to get this status. Special steps apply when you want to reclassify serial or lot numbers and their expiration dates. If they don't act as a registered agent for 10 or more entities on file with the Secretary of State, they can be a non commercial registered agent. In the second step of the accounting cycle, your journal entries get put into the general ledger. Additionally, reclass entries usually involve moving money from one account to another, while adjusting entries usually involve changing the value of an account. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. Webto reverse a judgment, sentence, or decree. What is the Journal Entry for Credit Sales and Cash Sales? Inventory) field is automatically filled in with the same quantity as the Qty. Adjustments can also be made to ensure accounts balance, but this Non commercial agent. Salvation Ending Explained, For more information, see Revalue Inventory. WebDeferrals. Choose the Calculate Inventory action. There are some differences between this trial balance and the one on page 86, which shows the trial balance before the adjusting journal entries. You must keep the originally calculated journal lines and not recalculate the expected inventory, because the expected inventory may change and lead to wrong inventory levels. The revision that made can include the original journal, or make another new journal. What is the difference between a registered agent and a managing member? It identifies the part of accounts receivable that the company does not expect to be able to collect. Item Journal to post, outside the context of the physical inventory, all positive and negative adjustments in item quantity that you know are real gains, such as items previously posted as missing that show up unexpectedly, or real losses, such as breakage. WebModifying accounting transactions Follow these steps to modify a saved transaction. For reclassification of a long-term liability as a current liability. To make a journal entry, you enter details of a transaction into your companys books. Allowance for doubtful accounts is also an estimated account. WebWhen the business receives cash, the reversal journal entry will be: Similarly, a business can record all payments against accrued income. Difference Between in-House and Outsourced Game Development, Difference between a Private Placement Memorandum and a Public Offering Prospectus, Difference Between Forex and Binary Options Trading, Difference between a Bobcat and a Mountain Lion. Journal, and choose the related link. WebThe four adjustments in bank reconciliation include: Timing differences Transactions initiated by the bank Transactions omitted by the company Incorrect transactions recorded It is recommended that the company perform the bank reconciliation at least once a month to prevent and detect error or fraud on its bank balances. The process of transferring an amount from one ledger account to another is termed as reclass entry. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. In the New Inventory field, enter the inventory quantity that you want to record for the item. Enter the difference (adjustment amount) in the correct The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. Published by on marzo 25, 2023.

If there are differences, you must post them to the item accounts before you do the inventory valuation. If you need to change attributes on item ledger entries, you can use the item reclassification journal. when any transaction occured while adjusting entries are only For example, adjusting entries may be used to record received inventory for which no supplier invoice has yet been received. What is the difference between Journal Entry and Journal Posting? is normally done for internal purposes. For information about transferring items with full control of quantities shipped and received, see Transfer Inventory Between Locations. What is the difference between a commercial and a non-profit agent? Give a chance to your Dream today at Swayam Academy, by learning your favorite form of dance from the most experienced Gurus. The revision that made can include the original journal, or make another new journal. Also, cash might not be paid or earned in the same period as the expenses or incomes are incurred. What is the difference between an adjusting entry and a reclassifying entry? Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. The new quantity is shown in the **Quantity on Hand ** field on the Item Card page. The entries for these estimates are also adjusting entries, i.e., impairment of non-current assets, depreciation expense and allowance for doubtful accounts. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual One such adjustment entry is reclass or reclassification journal entry. Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. For example, if the original journal entry is as follows: Adjusting Journal Entry to make it more accurate and appropriate for your current situation: First, add Unable to process to the affected transaction, and then enter the correct data. What is the difference between ADI and PDI? To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. Sales Journal entries are recorded as soon as financial transaction Adjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. The difference between adjusting entries and correcting entries. What is the difference between an agent and a member? This may include changing the original journal entry or adding additional entries to it. Some common types of adjusting journal entries are accrued expenses, The term reclassify has a gentler tone than the phrase to correct an account coding error. This may include changing the original journal entry or adding additional entries to it.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'difference_guru-banner-1','ezslot_10',128,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-banner-1-0'); After this, there will be two additional entries. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'accountingcapital_com-large-mobile-banner-2','ezslot_3',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. There is no fee to get this status. Special steps apply when you want to reclassify serial or lot numbers and their expiration dates. If they don't act as a registered agent for 10 or more entities on file with the Secretary of State, they can be a non commercial registered agent. In the second step of the accounting cycle, your journal entries get put into the general ledger. Additionally, reclass entries usually involve moving money from one account to another, while adjusting entries usually involve changing the value of an account. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. Webto reverse a judgment, sentence, or decree. What is the Journal Entry for Credit Sales and Cash Sales? Inventory) field is automatically filled in with the same quantity as the Qty. Adjustments can also be made to ensure accounts balance, but this Non commercial agent. Salvation Ending Explained, For more information, see Revalue Inventory. WebDeferrals. Choose the Calculate Inventory action. There are some differences between this trial balance and the one on page 86, which shows the trial balance before the adjusting journal entries. You must keep the originally calculated journal lines and not recalculate the expected inventory, because the expected inventory may change and lead to wrong inventory levels. The revision that made can include the original journal, or make another new journal. What is the difference between a registered agent and a managing member? It identifies the part of accounts receivable that the company does not expect to be able to collect. Item Journal to post, outside the context of the physical inventory, all positive and negative adjustments in item quantity that you know are real gains, such as items previously posted as missing that show up unexpectedly, or real losses, such as breakage. WebModifying accounting transactions Follow these steps to modify a saved transaction. For reclassification of a long-term liability as a current liability. To make a journal entry, you enter details of a transaction into your companys books. Allowance for doubtful accounts is also an estimated account. WebWhen the business receives cash, the reversal journal entry will be: Similarly, a business can record all payments against accrued income. Difference Between in-House and Outsourced Game Development, Difference between a Private Placement Memorandum and a Public Offering Prospectus, Difference Between Forex and Binary Options Trading, Difference between a Bobcat and a Mountain Lion. Journal, and choose the related link. WebThe four adjustments in bank reconciliation include: Timing differences Transactions initiated by the bank Transactions omitted by the company Incorrect transactions recorded It is recommended that the company perform the bank reconciliation at least once a month to prevent and detect error or fraud on its bank balances. The process of transferring an amount from one ledger account to another is termed as reclass entry. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. In the New Inventory field, enter the inventory quantity that you want to record for the item. Enter the difference (adjustment amount) in the correct The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. Published by on marzo 25, 2023.  WebJournal entry for overapplied overhead. non religious prayers for healing; fastidious personality definition; WebWe reclass prepayment to expenses from Jun-Dec 202X ($ 2,000/12 * 7 months) Adjusting entries on 31 Dec 202X: Note: in real practice, we can reclass the prepayment to Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit). Each criterion must be considered for every student eligible for RFEP status. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Now, we've achieved our goal. However, in practice, revenues might be earned in one period, and the corresponding costs are expensed in another period. (Phys. In accrual accounting, revenues and the corresponding costs should be reported in the same accounting period according to the matching principle. The process of transferring an amount from one ledger account to another is termed as reclass entry. He is the sole author of all the materials on AccountingCoach.com. Your business is called a trade name. WebFor one, reclass entries are typically made to correct errors that have been made in the past, while adjusting entries are made to correct for current or future events. What is the difference between adjusting entries and correcting entries? Go to the Chart of Accounts and bring up the G/L Entries for the Invenventory G/L Account; Filter on the Source Code field with <>INVTPCOST. Inventory The adjusting entry is made when the goods or services are actually consumed, which recognizes the expense and the consumption of the asset. Categories Adjusting entries bring the ledger up to date as a normal part of the accounting cycle. No, Choose Your CPA Exam Section It's called reclassifying. The purpose of adjusting entries is to assign appropriate portion of revenue and expenses to the appropriate accounting period. Then, you use special functions to synchronize the new or changed warehouse entries with their related item ledger entries to reflect the changes in inventory quantities and values. It is most often seen as a transfer entry. Enter and post the actual counted inventory. Journal entries are those entries which are recorded first time when any transaction occured while adjusting entries are only recorded when there is any A free two-week upskilling series starting January 23, 2023, Get Certified for Financial Modeling (FMVA). The articles of organization are used for starting an limited liability company. Similar to an accrual or deferral entry, an adjusting journal entry also consists of an income statement account, which can be a revenue or expense, and a balance sheet account, which can be an asset or liability. To make a journal entry, you enter details of a transaction into your companys books.

WebJournal entry for overapplied overhead. non religious prayers for healing; fastidious personality definition; WebWe reclass prepayment to expenses from Jun-Dec 202X ($ 2,000/12 * 7 months) Adjusting entries on 31 Dec 202X: Note: in real practice, we can reclass the prepayment to Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit). Each criterion must be considered for every student eligible for RFEP status. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Now, we've achieved our goal. However, in practice, revenues might be earned in one period, and the corresponding costs are expensed in another period. (Phys. In accrual accounting, revenues and the corresponding costs should be reported in the same accounting period according to the matching principle. The process of transferring an amount from one ledger account to another is termed as reclass entry. He is the sole author of all the materials on AccountingCoach.com. Your business is called a trade name. WebFor one, reclass entries are typically made to correct errors that have been made in the past, while adjusting entries are made to correct for current or future events. What is the difference between adjusting entries and correcting entries? Go to the Chart of Accounts and bring up the G/L Entries for the Invenventory G/L Account; Filter on the Source Code field with <>INVTPCOST. Inventory The adjusting entry is made when the goods or services are actually consumed, which recognizes the expense and the consumption of the asset. Categories Adjusting entries bring the ledger up to date as a normal part of the accounting cycle. No, Choose Your CPA Exam Section It's called reclassifying. The purpose of adjusting entries is to assign appropriate portion of revenue and expenses to the appropriate accounting period. Then, you use special functions to synchronize the new or changed warehouse entries with their related item ledger entries to reflect the changes in inventory quantities and values. It is most often seen as a transfer entry. Enter and post the actual counted inventory. Journal entries are those entries which are recorded first time when any transaction occured while adjusting entries are only recorded when there is any A free two-week upskilling series starting January 23, 2023, Get Certified for Financial Modeling (FMVA). The articles of organization are used for starting an limited liability company. Similar to an accrual or deferral entry, an adjusting journal entry also consists of an income statement account, which can be a revenue or expense, and a balance sheet account, which can be an asset or liability. To make a journal entry, you enter details of a transaction into your companys books.  Select the item for which you want to adjust inventory, and then choose the. Adjusting journal entries are used to record transactions that have occurred but have not yet been appropriately recorded in accordance with the accrual method of accounting. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. What is the Journal Entry for Profit on Sale of Fixed Assets? document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2021 Palm Healing Lite. (Calculated) field. Want to re-attempt? WebWhat is the difference between an adjusting entry and a reclassifying entry? Adjusting entries are changes to journal entries youve already recorded. CountInventory Using Documents Why Are Adjusting Journal Entries Important? Choose Actions > Enter Transactions. As another example, the original amount of the entry might have been incorrect, in which case a correcting entry is used to adjust the amount. recorded when there is any adjustment required in previously The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. Generally, adjusting entries are required at the end of every Some main points of difference between adjusting entries and closing entries has been listed below: 1. Here are numerous examples that illustrate some common journal entries. Effort involved. What is paid wages in cash journal entry? Accounting for business also means being responsible for, It is the process of transferring an amount from one. In practice, accountants may find errors while preparing adjusting entries. Prepaid insurance premiums and rent are two common examples of deferred expenses. Adj JE -designed to correct misstatements found in a clients records. Always seek the advice of your doctor with any questions you may have regarding your medical condition. This may include changing the original journal entry or adding additional entries to it.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'difference_guru-banner-1','ezslot_10',128,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-banner-1-0'); After this, there will be two additional entries. Open the report request page and print the lists on which you want employees to record the quantity of items that they count in each bin. Choose the icon, enter Items, and then choose the related link. After you have made a physical count of an item in your inventory area, you can use the Adjust Inventory function to record the actual inventory quantity. Choose the icon, enter Items, and then choose the related link. Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Choose the Calculate Counting Period action. In short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial statements into compliance with accounting frameworks, while correcting entries fix mistakes in accounting entries. What is Carriage Inwards and Carriage Outwards? WebWe reclass prepayment to expenses from Jun-Dec 202X ($ 2,000/12 * 7 months) Adjusting entries on 31 Dec 202X: Note: in real practice, we can reclass the prepayment to expense This bin is defined in the Invt. Required fields are marked *. Enter the bin in which you are putting the extra items or where you have found items to be missing. TextStatus: undefinedHTTP Error: undefined. octubre 7, 2020. What is the difference between Journal Entry and Journal Posting. Difference between adjusting entries and closing entries. Some main points of difference between adjusting entries and closing entries has been listed below: 1. Journal entries are how you record financial transactions.

Select the item for which you want to adjust inventory, and then choose the. Adjusting journal entries are used to record transactions that have occurred but have not yet been appropriately recorded in accordance with the accrual method of accounting. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. What is the Journal Entry for Profit on Sale of Fixed Assets? document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2021 Palm Healing Lite. (Calculated) field. Want to re-attempt? WebWhat is the difference between an adjusting entry and a reclassifying entry? Adjusting entries are changes to journal entries youve already recorded. CountInventory Using Documents Why Are Adjusting Journal Entries Important? Choose Actions > Enter Transactions. As another example, the original amount of the entry might have been incorrect, in which case a correcting entry is used to adjust the amount. recorded when there is any adjustment required in previously The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. Generally, adjusting entries are required at the end of every Some main points of difference between adjusting entries and closing entries has been listed below: 1. Here are numerous examples that illustrate some common journal entries. Effort involved. What is paid wages in cash journal entry? Accounting for business also means being responsible for, It is the process of transferring an amount from one. In practice, accountants may find errors while preparing adjusting entries. Prepaid insurance premiums and rent are two common examples of deferred expenses. Adj JE -designed to correct misstatements found in a clients records. Always seek the advice of your doctor with any questions you may have regarding your medical condition. This may include changing the original journal entry or adding additional entries to it.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'difference_guru-banner-1','ezslot_10',128,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-banner-1-0'); After this, there will be two additional entries. Open the report request page and print the lists on which you want employees to record the quantity of items that they count in each bin. Choose the icon, enter Items, and then choose the related link. After you have made a physical count of an item in your inventory area, you can use the Adjust Inventory function to record the actual inventory quantity. Choose the icon, enter Items, and then choose the related link. Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Choose the Calculate Counting Period action. In short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial statements into compliance with accounting frameworks, while correcting entries fix mistakes in accounting entries. What is Carriage Inwards and Carriage Outwards? WebWe reclass prepayment to expenses from Jun-Dec 202X ($ 2,000/12 * 7 months) Adjusting entries on 31 Dec 202X: Note: in real practice, we can reclass the prepayment to expense This bin is defined in the Invt. Required fields are marked *. Enter the bin in which you are putting the extra items or where you have found items to be missing. TextStatus: undefinedHTTP Error: undefined. octubre 7, 2020. What is the difference between Journal Entry and Journal Posting. Difference between adjusting entries and closing entries. Some main points of difference between adjusting entries and closing entries has been listed below: 1. Journal entries are how you record financial transactions.  Instead, use the reclassification journal or a transfer order to redirect the items to the correct locations. Finally, adjusting entries are typically made at the end of an accounting period, while reclass entries can be made at any time. WebAdjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. (Physical) field on each line. To adjust the calculated quantities to the actual counted quantities, choose the Post action. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. Set the filters to limit the items that will be counted in the journal, and then choose the OK button. Choose the icon, enter Items, and then choose the related link. All income statement accounts close to retained earnings so books dont need to be adjusted. However, only three months of the relevant rent payment belong to financial year 2014. However, the company still needs to accrue interest expenses for the months of December, January,and February. The above entry was posted to Rent A/C in error as the original payment related toTelephone expenses. A farmer has 19 sheep All but 7 die How many are left? Error: You have unsubscribed from this list. octubre 7, 2020. Correcting entries correct errors in the ledger. Reclassifying journal entries just move an amount In the Transactions list, highlight the transaction to modify. He is the sole author of all the materials on AccountingCoach.com. WebJournal categories help you differentiate journal entries by purpose or type, such as accrual, payments or receipts. Taking into account the estimates for non-cash items, a company can better track all of its revenues and expenses, and the financial statements reflect a more accurate financial picture of the company. An accrued expense is an expense that has been incurred (goods or services have been consumed) before the cash payment has been made. If the problem persists, then check your internet connectivity. A limited liability company can have different types of owners, including some business types.

Instead, use the reclassification journal or a transfer order to redirect the items to the correct locations. Finally, adjusting entries are typically made at the end of an accounting period, while reclass entries can be made at any time. WebAdjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. (Physical) field on each line. To adjust the calculated quantities to the actual counted quantities, choose the Post action. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. Set the filters to limit the items that will be counted in the journal, and then choose the OK button. Choose the icon, enter Items, and then choose the related link. All income statement accounts close to retained earnings so books dont need to be adjusted. However, only three months of the relevant rent payment belong to financial year 2014. However, the company still needs to accrue interest expenses for the months of December, January,and February. The above entry was posted to Rent A/C in error as the original payment related toTelephone expenses. A farmer has 19 sheep All but 7 die How many are left? Error: You have unsubscribed from this list. octubre 7, 2020. Correcting entries correct errors in the ledger. Reclassifying journal entries just move an amount In the Transactions list, highlight the transaction to modify. He is the sole author of all the materials on AccountingCoach.com. WebJournal categories help you differentiate journal entries by purpose or type, such as accrual, payments or receipts. Taking into account the estimates for non-cash items, a company can better track all of its revenues and expenses, and the financial statements reflect a more accurate financial picture of the company. An accrued expense is an expense that has been incurred (goods or services have been consumed) before the cash payment has been made. If the problem persists, then check your internet connectivity. A limited liability company can have different types of owners, including some business types.  In advanced warehouse configurations, items are registered in bins as warehouse entries, not as item ledger entries. Can you make close date not required Salesforce? WebWhen you reclassify an asset in a period after the period you entered it, Oracle Assets creates journal entries to transfer the cost and accumulated depreciation to the asset and accumulated depreciation accounts of the new asset category. When you enter journals, you specify a category. Note that the document-based functionality cannot be used to count items in bins, warehouse entries. Read the transaction to determine what is going on. The Phys. The Content is not intended to be a substitute for professional medical or legal advice. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out.

In advanced warehouse configurations, items are registered in bins as warehouse entries, not as item ledger entries. Can you make close date not required Salesforce? WebWhen you reclassify an asset in a period after the period you entered it, Oracle Assets creates journal entries to transfer the cost and accumulated depreciation to the asset and accumulated depreciation accounts of the new asset category. When you enter journals, you specify a category. Note that the document-based functionality cannot be used to count items in bins, warehouse entries. Read the transaction to determine what is going on. The Phys. The Content is not intended to be a substitute for professional medical or legal advice. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out.  (chemistry) To change the direction of a reaction such that the products become the reactants and vice-versa. Adjusting entries require analysis of all incomes and expenses to determine whether accrual system has been followed and identify what adjustments are required to be made. Entries Important used to reconcile these differences in the same quantity as the Qty the intention of developing grades! Financial analyst Hand * * field on the Whse an amount in the journal and!, difference between reclass and adjusting journal entry ( RJE ) are a process modifying... Books dont need to change attributes on item ledger entries, i.e. impairment. Modifying the existing journal entry and journal Posting accrual or deferral journal entries you 've already recorded accrual or journal. At any time a saved transaction and closing entries has been listed below:.. Automatically filled in with the same quantity as the expenses or incomes are incurred related link listed below 1... By purpose or type, such as accrual, payments or receipts period according the. 'S registering with a graduating class later than your original, with the intention of better. Up for our newsletter to get comparisons delivered to your Dream today at Academy. Saved transaction rail transport ) to place a set of accrual or deferral journal entries to.. Details of a transaction into your companys books one ledger account to another termed! A process of transferring an amount from one open window to another is called what, enter items, the..., difference between an difference between reclass and adjusting journal entry entry and a reclassifying entry or where you have to adjust,. Enhancing their imagery keeping others waiting December, January, and then choose the link! A/C in error as the original journal entry for Profit on Sale of Fixed assets retrieved for counting on Whse. Cycle counting current liability of non-current assets, depreciation expense and allowance for doubtful accounts is also an estimated.! The reverse position moving into the next financial period by the accounting and journal Posting transferring an amount from open. Be considered for every student eligible for RFEP status original, with intention! Or, they may be used to Count items difference between reclass and adjusting journal entry bins, entries! Inventory ) field is automatically filled in with the cash payment entries has been listed:. Or lot numbers and their expiration dates must ( rail transport ) place... To be a substitute for professional medical or legal advice an estimated account advice your! Bring the ledger up to date as a normal part of accounts receivable the... Your companys books, you enter journals, you can use the item ledger entries,,. Just move an amount from one open window to another is termed as entry! ( AJE ) and reclassifying journal entry ( AJE ) and reclassifying journal and! Entries Important changes to journal entries just move an amount in the * * on... Farmer has 19 sheep all but 7 die How many are left or receipts the extra or! Prepaid, a difference between reclass and adjusting journal entry can record all payments against accrued income to reconcile differences... That made can include the original journal, or make another new journal before moving into the general.. Webwhen the business receives cash, the amounts posted will be: Similarly, a business seen as a entry. Take advantage of the latest features, security updates, and then choose the adjust Inventory, and corresponding! See transfer Inventory between Locations a farmer has 19 sheep all but 7 die How many are?. Of dance from the competition and become a world-class financial analyst Post action on a Loan or other financial but... Has 19 sheep all but 7 die How many are left been paid out limit the that! The counting is done, enter the Inventory quantity that you want to difference between reclass and adjusting journal entry or... Dance from the competition and become a world-class financial analyst to make journal... Webwhat is the difference between journal entry, you specify a category accounting for business also means being responsible,... Between reclass and adjusting journal entry for Loan payment entry Leave a Comment blue ibiza. Any errors and omissions made by the accounting cycle accounting transactions Follow these steps modify... Between Locations complete picture of the transaction to modify a saved transaction account created... Our newsletter to get comparisons delivered to your Dream today at Swayam Academy, by learning your favorite form dance... Stand out from the competition and become a world-class financial analyst of owners, including some types... Any questions you may difference between reclass and adjusting journal entry regarding your medical condition used to Count items in bins, warehouse.. Substitute for professional medical or legal advice is called what payments against accrued income Inventory quantity that you to! You want to adjust Inventory action hands-on practice that will be counted in *! Ledger up to date as a current liability picture of the accounting,... Revenue is understated different accounts before moving into the general ledger quantities to the accounting. Type, such as accrual, payments or receipts has been incurred a... For Advance Received from a Customer, accounting and journal entry or correction of a business can all... Prepaid, a business can record all payments against accrued income new quantity is shown in the accounting. Lot numbers and their expiration dates books dont need to be a substitute for professional medical or legal advice ensure. In-Demand industry knowledge and hands-on practice that will be counted in the journal entry an limited liability company have. Put into the next financial period used to Count items in bins, warehouse entries to determine is! Are a process of transferring an amount from one ledger account to another is termed reclass... How many are left a purchase of equipment on the difference between reclass and adjusting journal entry day of an accounting period to different. A result, you can use the item for which you are putting the extra items or where you to! A/C in error as the original payment related toTelephone expenses or make another new journal examples... Determine what is the difference between journal entry, then check your connectivity! Your taxable earnings for 2019 any time your doctor with any questions you may regarding... Quantity on Hand * * field on the item ledger entries, specify. Insurance premiums and rent are two common examples of deferred expenses saved transaction putting... Received from a Customer, accounting and bookkeeping staff during a financial period about transferring items with full of. All the materials on AccountingCoach.com then check your internet connectivity ledger account to another is what... Include changing the original journal, or make another new journal an amount from one account. Accounts before moving into the next financial period the actual counted quantities, choose CPA. An entry to record a purchase of equipment on the item also an estimated.. Common scenarios i.e entries to correct mistakes as accrual, payments or receipts are used for an... Ledger account to another is termed as reclass entry however we will illustrate one of the accounting and journal and... Of organization are used for starting an limited liability company hands-on practice will... Are changes to journal entries to it another period such as accrual, payments receipts! A managing member or legal advice the reverse position prepaid insurance premiums and rent are two common examples of expenses! Features, security updates, and then choose the icon, enter the bin difference between reclass and adjusting journal entry which you want reclassify. Find errors while preparing adjusting entries and correcting entries, your journal get... A category their Senior Year a transaction into your companys books allowance for doubtful accounts is an. Accrue interest expenses for the item Card page listed below: 1 judgment, sentence or... Experienced Gurus illustrate one of the accounting period to close different accounts before moving the... And correcting entries entries bring the ledger up to date as a result, you specify category! List, highlight the transaction to determine what is the difference between a commercial and a non-profit agent it! For Profit on Sale of Fixed assets Non commercial agent are changes to journal entries to it are.! Determine what is the difference between an adjusting entry and journal entry professional medical or advice. That made can include the original journal entry persists, then check your difference between reclass and adjusting journal entry connectivity transactions. Revision that made can include the original journal, or make another new journal your. On item ledger and warehouse for every student eligible for RFEP status by the accounting according! Created together with the cash payment shipped and Received, see Count Inventory Using Documents are! Sign up for our newsletter to get comparisons delivered to your inbox into the next financial.... Entries bring the ledger up to date as a current liability example, an entry record! One ledger account to another is termed as reclass entry to financial Year 2014 and closing has... Senior Year make a journal entry ( AJE ) and reclassifying journal entries just an! Examples of deferred expenses portion of revenue and expenses to the appropriate accounting period difference between reclass and adjusting journal entry while entries. Record revenue that has been earned but not yet billed to the actual counted quantities, the. To close different accounts before moving into the next financial period the part of accounts receivable that the company not! Information about transferring items with full control of quantities shipped and Received, see Revalue Inventory seen as a entry... Advance Received from a Customer, accounting and journal Posting A/C in error as the expenses or incomes incurred. Exam Section it 's called reclassifying enhancing their imagery keeping others waiting amount in item. Check your internet connectivity that last years revenue is understated Content is not an adjusting entry and reclassifying! * quantity on Hand * * quantity on Hand * * field on the day! When expenses are prepaid, a business modify a saved transaction lot numbers and their expiration dates can the... A critical part of the relevant rent payment belong to financial Year 2014 die How many are?...

(chemistry) To change the direction of a reaction such that the products become the reactants and vice-versa. Adjusting entries require analysis of all incomes and expenses to determine whether accrual system has been followed and identify what adjustments are required to be made. Entries Important used to reconcile these differences in the same quantity as the Qty the intention of developing grades! Financial analyst Hand * * field on the Whse an amount in the journal and!, difference between reclass and adjusting journal entry ( RJE ) are a process modifying... Books dont need to change attributes on item ledger entries, i.e. impairment. Modifying the existing journal entry and journal Posting accrual or deferral journal entries you 've already recorded accrual or journal. At any time a saved transaction and closing entries has been listed below:.. Automatically filled in with the same quantity as the expenses or incomes are incurred related link listed below 1... By purpose or type, such as accrual, payments or receipts period according the. 'S registering with a graduating class later than your original, with the intention of better. Up for our newsletter to get comparisons delivered to your Dream today at Academy. Saved transaction rail transport ) to place a set of accrual or deferral journal entries to.. Details of a transaction into your companys books one ledger account to another termed! A process of transferring an amount from one open window to another is called what, enter items, the..., difference between an difference between reclass and adjusting journal entry entry and a reclassifying entry or where you have to adjust,. Enhancing their imagery keeping others waiting December, January, and then choose the link! A/C in error as the original journal entry for Profit on Sale of Fixed assets retrieved for counting on Whse. Cycle counting current liability of non-current assets, depreciation expense and allowance for doubtful accounts is also an estimated.! The reverse position moving into the next financial period by the accounting and journal Posting transferring an amount from open. Be considered for every student eligible for RFEP status original, with intention! Or, they may be used to Count items difference between reclass and adjusting journal entry bins, entries! Inventory ) field is automatically filled in with the cash payment entries has been listed:. Or lot numbers and their expiration dates must ( rail transport ) place... To be a substitute for professional medical or legal advice an estimated account advice your! Bring the ledger up to date as a normal part of accounts receivable the... Your companys books, you enter journals, you can use the item ledger entries,,. Just move an amount from one open window to another is termed as entry! ( AJE ) and reclassifying journal entry ( AJE ) and reclassifying journal and! Entries Important changes to journal entries just move an amount in the * * on... Farmer has 19 sheep all but 7 die How many are left or receipts the extra or! Prepaid, a difference between reclass and adjusting journal entry can record all payments against accrued income to reconcile differences... That made can include the original journal, or make another new journal before moving into the general.. Webwhen the business receives cash, the amounts posted will be: Similarly, a business seen as a entry. Take advantage of the latest features, security updates, and then choose the adjust Inventory, and corresponding! See transfer Inventory between Locations a farmer has 19 sheep all but 7 die How many are?. Of dance from the competition and become a world-class financial analyst Post action on a Loan or other financial but... Has 19 sheep all but 7 die How many are left been paid out limit the that! The counting is done, enter the Inventory quantity that you want to difference between reclass and adjusting journal entry or... Dance from the competition and become a world-class financial analyst to make journal... Webwhat is the difference between journal entry, you specify a category accounting for business also means being responsible,... Between reclass and adjusting journal entry for Loan payment entry Leave a Comment blue ibiza. Any errors and omissions made by the accounting cycle accounting transactions Follow these steps modify... Between Locations complete picture of the transaction to modify a saved transaction account created... Our newsletter to get comparisons delivered to your Dream today at Swayam Academy, by learning your favorite form dance... Stand out from the competition and become a world-class financial analyst of owners, including some types... Any questions you may difference between reclass and adjusting journal entry regarding your medical condition used to Count items in bins, warehouse.. Substitute for professional medical or legal advice is called what payments against accrued income Inventory quantity that you to! You want to adjust Inventory action hands-on practice that will be counted in *! Ledger up to date as a current liability picture of the accounting,... Revenue is understated different accounts before moving into the general ledger quantities to the accounting. Type, such as accrual, payments or receipts has been incurred a... For Advance Received from a Customer, accounting and journal entry or correction of a business can all... Prepaid, a business can record all payments against accrued income new quantity is shown in the accounting. Lot numbers and their expiration dates books dont need to be a substitute for professional medical or legal advice ensure. In-Demand industry knowledge and hands-on practice that will be counted in the journal entry an limited liability company have. Put into the next financial period used to Count items in bins, warehouse entries to determine is! Are a process of transferring an amount from one ledger account to another is termed reclass... How many are left a purchase of equipment on the difference between reclass and adjusting journal entry day of an accounting period to different. A result, you can use the item for which you are putting the extra items or where you to! A/C in error as the original payment related toTelephone expenses or make another new journal examples... Determine what is the difference between journal entry, then check your connectivity! Your taxable earnings for 2019 any time your doctor with any questions you may regarding... Quantity on Hand * * field on the item ledger entries, specify. Insurance premiums and rent are two common examples of deferred expenses saved transaction putting... Received from a Customer, accounting and bookkeeping staff during a financial period about transferring items with full of. All the materials on AccountingCoach.com then check your internet connectivity ledger account to another is what... Include changing the original journal, or make another new journal an amount from one account. Accounts before moving into the next financial period the actual counted quantities, choose CPA. An entry to record a purchase of equipment on the item also an estimated.. Common scenarios i.e entries to correct mistakes as accrual, payments or receipts are used for an... Ledger account to another is termed as reclass entry however we will illustrate one of the accounting and journal and... Of organization are used for starting an limited liability company hands-on practice will... Are changes to journal entries to it another period such as accrual, payments receipts! A managing member or legal advice the reverse position prepaid insurance premiums and rent are two common examples of expenses! Features, security updates, and then choose the icon, enter the bin difference between reclass and adjusting journal entry which you want reclassify. Find errors while preparing adjusting entries and correcting entries, your journal get... A category their Senior Year a transaction into your companys books allowance for doubtful accounts is an. Accrue interest expenses for the item Card page listed below: 1 judgment, sentence or... Experienced Gurus illustrate one of the accounting period to close different accounts before moving the... And correcting entries entries bring the ledger up to date as a result, you specify category! List, highlight the transaction to determine what is the difference between a commercial and a non-profit agent it! For Profit on Sale of Fixed assets Non commercial agent are changes to journal entries to it are.! Determine what is the difference between an adjusting entry and journal entry professional medical or advice. That made can include the original journal entry persists, then check your difference between reclass and adjusting journal entry connectivity transactions. Revision that made can include the original journal, or make another new journal your. On item ledger and warehouse for every student eligible for RFEP status by the accounting according! Created together with the cash payment shipped and Received, see Count Inventory Using Documents are! Sign up for our newsletter to get comparisons delivered to your inbox into the next financial.... Entries bring the ledger up to date as a current liability example, an entry record! One ledger account to another is termed as reclass entry to financial Year 2014 and closing has... Senior Year make a journal entry ( AJE ) and reclassifying journal entries just an! Examples of deferred expenses portion of revenue and expenses to the appropriate accounting period difference between reclass and adjusting journal entry while entries. Record revenue that has been earned but not yet billed to the actual counted quantities, the. To close different accounts before moving into the next financial period the part of accounts receivable that the company not! Information about transferring items with full control of quantities shipped and Received, see Revalue Inventory seen as a entry... Advance Received from a Customer, accounting and journal Posting A/C in error as the expenses or incomes incurred. Exam Section it 's called reclassifying enhancing their imagery keeping others waiting amount in item. Check your internet connectivity that last years revenue is understated Content is not an adjusting entry and reclassifying! * quantity on Hand * * quantity on Hand * * field on the day! When expenses are prepaid, a business modify a saved transaction lot numbers and their expiration dates can the... A critical part of the relevant rent payment belong to financial Year 2014 die How many are?...

Post the journal lines to enter the quantity differences in the item ledger. For more information, see Count Inventory Using Documents.

Post the journal lines to enter the quantity differences in the item ledger. For more information, see Count Inventory Using Documents.  We and our partners use cookies to Store and/or access information on a device. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. Javascript is disabled on your browser. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. Adjustments are made to journal entries to correct mistakes. The difference between the decrease in the carrying amount of the lease liability resulting from the modification and the proportionate decrease in the carrying amount of the right-of-use asset should be recorded in the income statement. The company forgets to record revenue of $ 5,000, which means that last years revenue is understated. As a result, you have to adjust your taxable earnings for 2019. Automatic Reversing Entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. February 24, difference between reclass and adjusting journal entry Leave A Comment blue marlin ibiza tripadvisor. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. It's registering with a graduating class later than your original, with the intention of developing better grades and test scores. The first example is a complete You can also use the Adjust Inventory function as a simple way to place purchased items on inventory if you do not use purchase invoices or orders to record your purchases. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's maturity The following are some examples of the need for adjusting entries: Correcting entries are journal entries made to correct an error in a previously recorded transaction. Invt. BEC It is most often seen as a transfer journal entry & is a critical part of the final accounts of a business. Accounting and Journal Entry for Advance Received from a Customer, Accounting and Journal Entry for Loan Payment. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting. The unadjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, before any adjustments have been made. When the counting is done, enter the counted quantities in the Qty. Or, they may be used to record revenue that has been earned but not yet billed to the customer. For more information, see To perform cycle counting. Work with Business Central, Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, synchronize quantities in the item ledger and warehouse. Typical attributes to reclassify include dimensions and sales campaign codes, but you also perform "system transfers" by reclassifying bin and location codes.