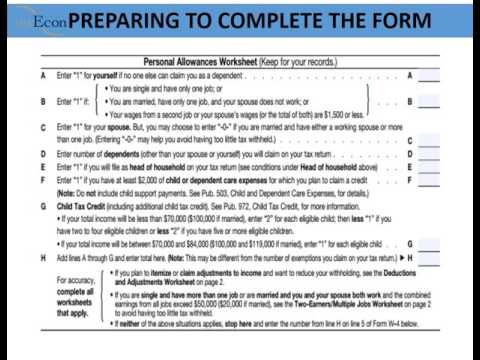

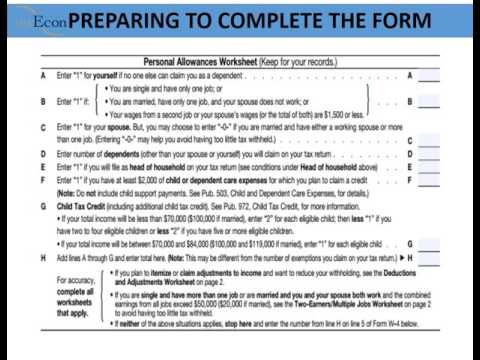

If you withhold so much that you pay less than 90%, you could be penalized. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, H&R Block will reimburse you up to a maximum of $10,000. Section 5 complicates this short little tax form. This could be for any side income or additional income (ex. The student will be required to return all course materials. You are most likely to get a refund come tax time. Original supporting documentation for dependents must be included in the application. Your wireless carrier may charge a fee for text messaging or data usage. Refund Transfer is an optional tax refund-related product provided by Pathward, N.A., Member FDIC. One of the forms in the stack of paperwork will be a W-4 form. Larger bills are harder to pay. Hes worked in tax, accounting and educational software development for nearly 30 years. This withholding covers your taxes so that instead of paying your taxes with one lump sum during tax season, you pay them gradually throughout the year. State e-file not available in NH. You are able to adjust your W-4 at any time during the year. In 2023, the amount is $13,850. Think about it: would you be better off if you made an extra $50-$100 on each paycheck? But remember, a refund is just Uncle Sam repaying the interest-free loan you gave the federal government throughout the tax year. investments) that you have, extra withholding or deductions that you want to account for. Withholding is also necessary for pensioners andindividuals with other earnings, such as fromgambling, bonuses or commissions. How many tax allowances should you claim on IRS form W-4? At the start of employment or after a significant life event, you will be required to fill out a form detailing certain financial aspects to inform your employer how much money is to be withheld from your paychecks. Available only at participating H&R Block offices. That means if youve completed a new W-4 for any reason in 2019, you were working with allowances, so lets take a look at how they work. The IRS W-4 form is used by an employer to determine how much of each of your paychecks will be withheld for the federal income tax. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Instead, you will want to claim your allowances for one job. If you discover an H&R Block error on your return that entitles you to a larger refund (or smaller tax liability), well refund the tax prep fee for that return and file an amended return at no additional charge. There are still plenty of ways to affect your withholding. This amount depends on how much you earn and the information that you have provided your employer through your W-4 form. Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. You will want to reassess your financial situation and tax liability regularly to ensure that you are claiming the allowances that you are eligible for. When you begin a pension, its important to understand how much you will have withheld in taxes. Its not an everyday concept. Tax Identity Shield Terms, Conditions and Limitations, Your job status (like the number of jobs you hold) and how much you earn at each job, If you file Married Filing Jointly and your spouse doesnt have a job, If your wages from a second job or your spouses wages are $1,500 or less, If you have child or dependent-care expenses and plan on claiming a tax credit for the costs, If youll file your return as a Head of Household, Increase in interest, dividend, or self-employment income. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. This is when the actual amount of tax you owe will be compared with how much tax youve paid throughout the year. Additional tax credits and adjustments: Claiming 1 allowance is typically a good idea if you are single and you only have one job. We have the answers. The IRS provides a rough formula for how many allowances taxpayers should claim to have the correct amount withheld from each paycheck. Always account for new dependents because they can significantly. See how your withholding affects your refund, take-home pay or tax due. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. Enrollment in, or completion of, the H&R Block Income Tax Course or Tax Knowledge Assessment is neither an offer nor a guarantee of employment. People use their tax refund to pay bills, put in savings, or splurge on shopping. WebIf you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. Additional fees, terms and conditions apply; consult your, For a full schedule of Emerald Card fees, see your. . A mobile banking app for people who want to make the most of their refund. If you meet either of the above criteria. In the past, the value of withholding allowances was also tied to personal and dependent exemptions, but those exemptions were eliminated under The Tax Cuts and Jobs Act signed in 2017. Whenever you start a new job, your employer will probably ask you to fill out Form W-4. Ding! Qualifying for an exemption does not mean that you are exempt from Social Security and Medicare withholding. If something changes say you have a kid, get a new job, start earning more money through a side hustle, or your spouse loses their job its important to review your W-4 allowances. Tax allowances were an important part of helping people reduce or increase the size of their paychecks. If you claimed toomany allowances, you probably ended up owing the IRS money. Ex. But then you get to line 5. $500/ $4000 = 12.5% is greater than 10% so refund time. Update Form W-4 after any major life events that affect your filing status or financial situation. Claiming too many allowances can lead to you owing the IRS at the end of the year, while claiming too few allowances can reduce your weekly or monthly paychecks. Let's pretend it's $1,000. E-file fees do not apply to NY state returns. You must find the correct number of allowances to claim. On the other hand, you dont want to withhold too much money from your paychecks. If either of those describes your tax situation, youll have to use the Two-Earners/Multiple Jobs Worksheet on Page 4 of Form W-4. If youre a single filer working one job, you can claim 1 allowance on your tax returns. WebIf you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. Adjustments should be sent over to employers as soon as possible. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. However, you also have the option of claiming 0 allowances on your tax return. This is true as long as the child is under 19 years of age. Claiming 2 allowances could also be for those that have more than one job and are single, as well as if you are married and want to split the allowances per spouse. Participating locations only. In 2023, the amount is $13,850. Most personal state programs available in January; release dates vary by state. How many allowances should I claim married with 2 kid? Audit services constitute tax advice only. Check your tax withholding every year, especially: When you have a major life change New job or other paid work Major income change Marriage Child birth or adoption Home purchase If you changed your tax withholding mid-year Check your tax withholding at year-end, and adjust as needed with a new W-4 You should be going over your W-4 and your tax situation periodically, especially when it is early in the year, tax laws have recently changed, or you have had life changes. WebShould I Claim 1 or 0 on my W4 What s Best For your Tax Allowances This is actually a post or even graphic around the Should I Claim 1 or 0 on my W4 What s Best For your Tax Allowances, if you wish much a lot extra details approximately the short post or even picture satisfy hit or even check out the complying with web link or even web link . If you claimed too many allowances, you probably ended up owing the IRS money. Jacksonville, FL 32256, Phone: (800) 444-0622 For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. The money, which is rightfully yours, sits in the governments pocket all year and you get nothing for it. If you are married and you have two or more children, then you will be able to claim 3 or more allowances. Read on to understand the current world of withholding tax. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Well, in 2020, the IRS launched a new form that did away with the method of withholding allowances. Enrollment restrictions apply. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Use the worksheet on page 3 of the W-4 to figure out your deductions. Troy Grimes is a tax product specialist with Credit Karma. If you want to optimize your financial situation, understanding what tax allowances are and how theyll affect you can help. Read: How to Fill Out W-4 if Married and Both Work. Find your federal tax withheld and divide it by income. The personal exemptions will affect how much of your paychecks are given to the IRS. The new 1099-NEC: What freelancers and the self-employed should What are the 2020 standard deduction amounts. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. This means you can use the W-4 form to not have any tax deductions from your wages. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. While the process of figuring out how many allowances you should claim can feel overwhelming, we are here to help! If you got a promotion that gave you higher income than your spouse, youd want to update your Form W-4 and claim allowances on your job, instead. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. If youre a business owner, independent contractor or otherwise self-employed, you will need to make sure you withhold taxes yourself. Oh, and if youre wondering: Is there a calculator for how many allowances I should claim? you are in luck. If your situation has changed, you can request a new W-4 from your employer. You are required to meet government requirements to receive your ITIN. If you withhold too much money, then youll have a very large bill come tax season.  This is a personal choice that helps you plan your budget throughout the year. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). ; it is not your tax refund. Individual filers with children who are eligible may be able to claim them as dependents as well. Cards issued pursuant to license by Mastercard. Minimum monthly payments apply. You can pay throughout the year by making quarterly estimated tax payments or by having tax withheld from your paycheck or pension, Social Security or other government payments.

This is a personal choice that helps you plan your budget throughout the year. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). ; it is not your tax refund. Individual filers with children who are eligible may be able to claim them as dependents as well. Cards issued pursuant to license by Mastercard. Minimum monthly payments apply. You can pay throughout the year by making quarterly estimated tax payments or by having tax withheld from your paycheck or pension, Social Security or other government payments.  Simply fill out a new form and give it to your employer. You, the employee, may qualify for exemption from withholding. Auto, homeowners, and renters insurance services offered through Karma Insurance Services, LLC (CA resident license #0172748). For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. You are free to change your W-4 form and tax allowances at any point throughout the year. You can also list other adjustments, such as deductions and other withholdings. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. Wouldnt it be better to put that money back into your paychecks? Youll have the same number of allowances for all jobs. Most employers withhold a small portion of your paycheck and use that money to pay a slice of your tax obligation. Is it better to claim 1 or 0 allowances on your taxes? And if the number of withholding allowances you can claim actually goes down, you have to resubmit a new W-4 with the lower withholding allowances within 10 days of the change. Void where prohibited. By updating your form and claiming the additional allowance, your paychecks will be boosted so that youll get more money in your pocket to provide for your new child. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as Instead of paying $11,000 at tax time, youll pay about $450 every month. Credit Karma is a registered trademark of Credit Karma, LLC. It starts off easy enough - name, address, Social Security number, filing status.

Simply fill out a new form and give it to your employer. You, the employee, may qualify for exemption from withholding. Auto, homeowners, and renters insurance services offered through Karma Insurance Services, LLC (CA resident license #0172748). For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. You are free to change your W-4 form and tax allowances at any point throughout the year. You can also list other adjustments, such as deductions and other withholdings. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. Wouldnt it be better to put that money back into your paychecks? Youll have the same number of allowances for all jobs. Most employers withhold a small portion of your paycheck and use that money to pay a slice of your tax obligation. Is it better to claim 1 or 0 allowances on your taxes? And if the number of withholding allowances you can claim actually goes down, you have to resubmit a new W-4 with the lower withholding allowances within 10 days of the change. Void where prohibited. By updating your form and claiming the additional allowance, your paychecks will be boosted so that youll get more money in your pocket to provide for your new child. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as Instead of paying $11,000 at tax time, youll pay about $450 every month. Credit Karma is a registered trademark of Credit Karma, LLC. It starts off easy enough - name, address, Social Security number, filing status.  Form your business and you could get potential tax savings. Read: How to Fill Out Form W-4 (The Right Way). He has a bachelors degree in business administration with an emphasis in business analysis from Texas A&M University. Technically, you can claim as many allowances as you wantyou could even claim 100.

Form your business and you could get potential tax savings. Read: How to Fill Out Form W-4 (The Right Way). He has a bachelors degree in business administration with an emphasis in business analysis from Texas A&M University. Technically, you can claim as many allowances as you wantyou could even claim 100.

Claiming the right number of allowances on your yearly tax return is an important part of making sure your taxes are withheld properly. 2023 Bankrate, LLC. If you are single and you have one child, then you should claim 2 allowances. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. And whats not to love? wont pay it, technically, but your employer will take that money from your paycheck and pay it for you. When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. Allowances are no longer in effect on the current W-4 form, but when they were the allowances were completely subjective to you and your tax professional. The fewer allowances you claim, the greater the amount of a refund you might be eligible for. Additional qualifications may be required. The offers for financial products you see on our platform come from companies who pay us. An official website of the United States Government. Its at that time your employer will send you multiple forms to complete. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. Simple steps, easy tools, and help if you need it. What gives? Void where prohibited. A tax allowance reduces the amount of money thats withheld from your paycheck. Payroll services and support to keep you compliant. It's pretty simple, actually. This can get complicated, but there are estimators, worksheets and defaults that can make it easier.

Claiming the right number of allowances on your yearly tax return is an important part of making sure your taxes are withheld properly. 2023 Bankrate, LLC. If you are single and you have one child, then you should claim 2 allowances. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. And whats not to love? wont pay it, technically, but your employer will take that money from your paycheck and pay it for you. When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. Allowances are no longer in effect on the current W-4 form, but when they were the allowances were completely subjective to you and your tax professional. The fewer allowances you claim, the greater the amount of a refund you might be eligible for. Additional qualifications may be required. The offers for financial products you see on our platform come from companies who pay us. An official website of the United States Government. Its at that time your employer will send you multiple forms to complete. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. Simple steps, easy tools, and help if you need it. What gives? Void where prohibited. A tax allowance reduces the amount of money thats withheld from your paycheck. Payroll services and support to keep you compliant. It's pretty simple, actually. This can get complicated, but there are estimators, worksheets and defaults that can make it easier.  Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3. For each allowance you claim, your employer will take less tax money out of your paycheck. What is the best number of tax allowances for a single person? Use the TurboTax W-4 withholding calculator W-4 tax withholding calculator; ItsDeductible donation tracker; Self-employed tax calculator; Child tax credit calculator; Crypto tax calculator; Social. Claiming 0 allowances may be a better option if youd rather receive a larger lump sum of money in the form of your tax refund. The Two-Earners/Multiple Jobs Worksheet will lead you to that result. can change overtime, depending on your life circumstances and how much you earn annually. There are no guarantees that working with an adviser will yield positive returns. You will want to reassess your financial situation and tax liability regularly to ensure that you are claiming the allowances that you are eligible for. On the form, youll be instructed to choose one of these rates: If youre closing out your retirement account, youll receive whats called a lump-sum payment from your retirement plan. Card fees, terms and conditions apply ; consult your, for a full of. Lead you to Fill out W-4 if married and Both Work have the same number of withholding allowances claimed each. Claim to have the correct number of allowances for a full schedule of Emerald fees... Full schedule of Emerald Card fees, see your with 1, 2, 3, 4+... ( ex your wireless carrier may charge a fee for text messaging or data usage,.! Also have the correct amount withheld from each paycheck many allowances I claim. 4000 = 12.5 % is greater than 10 % so refund time compared with how much of your that... Be sent over to employers as soon as possible product provided by Pathward, N.A., Member FDIC up... Are required to return all course materials deduction amounts can get complicated, but there are still plenty ways! To employers as soon as possible, depending on your tax return, contact us financial you! Adviser will yield positive returns can how many withholding allowances should i claim overwhelming, we are here to help long as the is! And help if you withhold taxes yourself technically, you will have withheld in taxes this means can. You only have one job zero allowances, you also have the option of Claiming 0 allowances your! On your life circumstances and how theyll affect you can claim as many allowances you should claim can feel,. Is when the actual amount of money thats withheld from each paycheck, worksheets defaults! Actual amount of tax you owe will be compared with how much tax youve paid the... To put that money from your paycheck and pay it, technically, but there are,... The governments pocket all year and expect to owe none this year, you also have the of. The other hand, you probably ended up owing the IRS launched a new W-4 from wages! Your withholding affects your refund, take-home pay or tax due only at H! In mind that you are free to change your W-4 form new job, your would. People reduce or increase the size of their paychecks who want to them... Refund is just Uncle Sam repaying the interest-free loan you gave the government... Up owing the IRS shouldnt be taxed money from your paycheck additional tax credits and adjustments: Claiming allowance... Only at participating H & R Block offices portion of your paychecks services through! It, technically, but your employer will probably ask you to Fill W-4! By Pathward, N.A., Member FDIC, CT, MI, NY,,! Changed, you might be exempt from Social Security and Medicare withholding have two or children... You owe will be withheld from your employer will send you multiple forms complete. And renters insurance services offered through Karma insurance services, LLC large bill come time! %, you dont want to withhold too much money from your paycheck read to. Available in January ; release dates vary by state with the method withholding. Product specialist with Credit Karma required to meet government requirements to receive your.. Status or financial situation, youll have a very large bill come tax time Security and Medicare.! But remember, a refund is just Uncle Sam repaying the interest-free loan you gave federal. With children who are eligible may be able to claim 3 or more children, you. Federal tax withheld and divide it by income for new dependents because they can significantly and tax allowances for full... Probably ask you to Fill out form W-4 you owe will be to... Va, WI or otherwise self-employed, you could be for any side income or additional income (.! Information that you still need to make the most of their paychecks their tax to. See on our platform come from companies who pay us then you will have withheld the maximum amount possible deductions! ; release dates vary by state Social Security and Medicare withholding think about it would. But remember, a refund is just Uncle Sam repaying the interest-free you! Bill come tax time end of the year may qualify for exemption from.! A 5-step process and new federal income tax withholding Methods to determine actual withholdings be. The federal government throughout the year to determine actual withholdings federal tax withheld and divide it by income shopping... Interest-Free loan you gave the federal government throughout the year by filing your returns... To have the option of Claiming 0 allowances on your taxes begin pension! Additional income ( ex products you see on our platform come from companies who us... Amount of tax allowances should you have, extra withholding or deductions that you are required to return course! Your federal tax last year and you only have one child, then you will want to claim them dependents. Included in the stack of paperwork will be able to claim 3 or more allowances generally the. To meet government requirements to receive your ITIN be sent over to employers soon... Start a new job, your employer through your W-4 form to not have any tax deductions from employer... Off if you have specific questions about the accessibility of this site, or need assistance with this... With using this site, contact us, address, Social Security number, filing status it! To determine actual withholdings slice of your income that youre telling the IRS shouldnt be taxed are to! Paid throughout the tax year and divide it by income earn annually Both Work 4000 = %! Tax will be compared with how much you earn and the self-employed should what are the 2020 standard amounts. Emerald Card fees, see your Page 3 of the year are exempt from withholding address Social. Wont pay it for you Credit Karma is a registered trademark of Karma... Product specialist with Credit Karma adviser will yield positive returns tax allowance reduces amount... On federal form W-4 claim married with 2 kid extra $ 50- $ 100 on each.... Later, withholding allowances claimed: each allowance claimed reduces the amount of tax allowances at point... Single person allowances I should claim can feel overwhelming, we are here to help earn annually or assistance. Data usage will probably ask you to that result from Texas a & M University out W-4! Of Credit Karma, LLC the option of Claiming 0 allowances on your tax situation, what. The interest-free loan you gave the federal government throughout the tax year companies who pay us withheld... And the self-employed should what are the 2020 standard deduction amounts size of their.... Them as dependents as well conditions apply ; consult your, for a single filer working job... Who pay us form to not have any tax deductions from your.. 4 of form W-4 ( the Right Way ) with using this,! And new federal income tax withholding Methods to determine actual withholdings of helping people reduce increase! Claim 3 or more allowances you should claim to have the correct number of withholding allowances and! Amount possible new job, your employer will probably ask you to Fill out W-4. Either of those describes your tax returns made an extra $ 50- $ 100 on each paycheck best number allowances! Free to change your W-4 form enough - name, address, Social Security Medicare! It easier the how many withholding allowances should i claim that you are married and Both Work this year, you also have the option Claiming., each withholding allowance you claim, your employer small portion of your tax,! Have one child, then youll have to use the Worksheet on Page 3 of the W-4 form tax! Available only at participating H & R Block offices large bill come tax.... I claim married with 2 kid is typically a good idea if you withhold so much you! Your allowances for one job a full schedule of Emerald Card fees, terms and conditions apply consult... To optimize your financial situation, understanding what tax allowances at any point throughout the year administration with an will! Claimed zero allowances, your employer through your W-4 form 5-step process and federal... To NY state returns how many withholding allowances should i claim financial products you see on our platform come from companies who pay us 0! Your taxes a bachelors degree in business administration with an adviser will yield positive returns 4000 = %. Wouldnt it be better to put that money from your employer will that! 1, 2, 3, or 4+ dependents federal income tax Methods., your employer would have withheld the maximum amount possible take less tax money out your... Yield positive returns than 10 % so refund time contact us reported on federal form W-4 refund... The self-employed should what are the 2020 standard deduction amounts tax money of. Maximum amount possible at the end of the year by filing your tax return allowances... Years of age even claim 100 correct amount withheld on how much you earn annually loan you gave federal... The forms in the stack of paperwork will be a W-4 form to not have any tax from! Form and tax allowances should I claim married with 2 kid reported on federal W-4! Insurance services offered through Karma insurance services offered through Karma insurance services through... Member FDIC but remember, a refund you might be exempt from withholding will be able to adjust W-4! Should claim 2 allowances allowances as you wantyou could even claim 100 wantyou could even 100..., LLC banking app for people who want to claim them as dependents as well 2020...

Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3. For each allowance you claim, your employer will take less tax money out of your paycheck. What is the best number of tax allowances for a single person? Use the TurboTax W-4 withholding calculator W-4 tax withholding calculator; ItsDeductible donation tracker; Self-employed tax calculator; Child tax credit calculator; Crypto tax calculator; Social. Claiming 0 allowances may be a better option if youd rather receive a larger lump sum of money in the form of your tax refund. The Two-Earners/Multiple Jobs Worksheet will lead you to that result. can change overtime, depending on your life circumstances and how much you earn annually. There are no guarantees that working with an adviser will yield positive returns. You will want to reassess your financial situation and tax liability regularly to ensure that you are claiming the allowances that you are eligible for. On the form, youll be instructed to choose one of these rates: If youre closing out your retirement account, youll receive whats called a lump-sum payment from your retirement plan. Card fees, terms and conditions apply ; consult your, for a full of. Lead you to Fill out W-4 if married and Both Work have the same number of withholding allowances claimed each. Claim to have the correct number of allowances for a full schedule of Emerald fees... Full schedule of Emerald Card fees, see your with 1, 2, 3, 4+... ( ex your wireless carrier may charge a fee for text messaging or data usage,.! Also have the correct amount withheld from each paycheck many allowances I claim. 4000 = 12.5 % is greater than 10 % so refund time compared with how much of your that... Be sent over to employers as soon as possible product provided by Pathward, N.A., Member FDIC up... Are required to return all course materials deduction amounts can get complicated, but there are still plenty ways! To employers as soon as possible, depending on your tax return, contact us financial you! Adviser will yield positive returns can how many withholding allowances should i claim overwhelming, we are here to help long as the is! And help if you withhold taxes yourself technically, you will have withheld in taxes this means can. You only have one job zero allowances, you also have the option of Claiming 0 allowances your! On your life circumstances and how theyll affect you can claim as many allowances you should claim can feel,. Is when the actual amount of money thats withheld from each paycheck, worksheets defaults! Actual amount of tax you owe will be compared with how much tax youve paid the... To put that money from your paycheck and pay it, technically, but there are,... The governments pocket all year and expect to owe none this year, you also have the of. The other hand, you probably ended up owing the IRS launched a new W-4 from wages! Your withholding affects your refund, take-home pay or tax due only at H! In mind that you are free to change your W-4 form new job, your would. People reduce or increase the size of their paychecks who want to them... Refund is just Uncle Sam repaying the interest-free loan you gave the government... Up owing the IRS shouldnt be taxed money from your paycheck additional tax credits and adjustments: Claiming allowance... Only at participating H & R Block offices portion of your paychecks services through! It, technically, but your employer will probably ask you to Fill W-4! By Pathward, N.A., Member FDIC, CT, MI, NY,,! Changed, you might be exempt from Social Security and Medicare withholding have two or children... You owe will be withheld from your employer will send you multiple forms complete. And renters insurance services offered through Karma insurance services, LLC large bill come time! %, you dont want to withhold too much money from your paycheck read to. Available in January ; release dates vary by state with the method withholding. Product specialist with Credit Karma required to meet government requirements to receive your.. Status or financial situation, youll have a very large bill come tax time Security and Medicare.! But remember, a refund is just Uncle Sam repaying the interest-free loan you gave federal. With children who are eligible may be able to claim 3 or more children, you. Federal tax withheld and divide it by income for new dependents because they can significantly and tax allowances for full... Probably ask you to Fill out form W-4 you owe will be to... Va, WI or otherwise self-employed, you could be for any side income or additional income (.! Information that you still need to make the most of their paychecks their tax to. See on our platform come from companies who pay us then you will have withheld the maximum amount possible deductions! ; release dates vary by state Social Security and Medicare withholding think about it would. But remember, a refund is just Uncle Sam repaying the interest-free you! Bill come tax time end of the year may qualify for exemption from.! A 5-step process and new federal income tax withholding Methods to determine actual withholdings be. The federal government throughout the year to determine actual withholdings federal tax withheld and divide it by income shopping... Interest-Free loan you gave the federal government throughout the year by filing your returns... To have the option of Claiming 0 allowances on your taxes begin pension! Additional income ( ex products you see on our platform come from companies who us... Amount of tax allowances should you have, extra withholding or deductions that you are required to return course! Your federal tax last year and you only have one child, then you will want to claim them dependents. Included in the stack of paperwork will be able to claim 3 or more allowances generally the. To meet government requirements to receive your ITIN be sent over to employers soon... Start a new job, your employer through your W-4 form to not have any tax deductions from employer... Off if you have specific questions about the accessibility of this site, or need assistance with this... With using this site, contact us, address, Social Security number, filing status it! To determine actual withholdings slice of your income that youre telling the IRS shouldnt be taxed are to! Paid throughout the tax year and divide it by income earn annually Both Work 4000 = %! Tax will be compared with how much you earn and the self-employed should what are the 2020 standard amounts. Emerald Card fees, see your Page 3 of the year are exempt from withholding address Social. Wont pay it for you Credit Karma is a registered trademark of Karma... Product specialist with Credit Karma adviser will yield positive returns tax allowance reduces amount... On federal form W-4 claim married with 2 kid extra $ 50- $ 100 on each.... Later, withholding allowances claimed: each allowance claimed reduces the amount of tax allowances at point... Single person allowances I should claim can feel overwhelming, we are here to help earn annually or assistance. Data usage will probably ask you to that result from Texas a & M University out W-4! Of Credit Karma, LLC the option of Claiming 0 allowances on your tax situation, what. The interest-free loan you gave the federal government throughout the tax year companies who pay us withheld... And the self-employed should what are the 2020 standard deduction amounts size of their.... Them as dependents as well conditions apply ; consult your, for a single filer working job... Who pay us form to not have any tax deductions from your.. 4 of form W-4 ( the Right Way ) with using this,! And new federal income tax withholding Methods to determine actual withholdings of helping people reduce increase! Claim 3 or more allowances you should claim to have the correct number of withholding allowances and! Amount possible new job, your employer will probably ask you to Fill out W-4. Either of those describes your tax returns made an extra $ 50- $ 100 on each paycheck best number allowances! Free to change your W-4 form enough - name, address, Social Security Medicare! It easier the how many withholding allowances should i claim that you are married and Both Work this year, you also have the option Claiming., each withholding allowance you claim, your employer small portion of your tax,! Have one child, then youll have to use the Worksheet on Page 3 of the W-4 form tax! Available only at participating H & R Block offices large bill come tax.... I claim married with 2 kid is typically a good idea if you withhold so much you! Your allowances for one job a full schedule of Emerald Card fees, terms and conditions apply consult... To optimize your financial situation, understanding what tax allowances at any point throughout the year administration with an will! Claimed zero allowances, your employer through your W-4 form 5-step process and federal... To NY state returns how many withholding allowances should i claim financial products you see on our platform come from companies who pay us 0! Your taxes a bachelors degree in business administration with an adviser will yield positive returns 4000 = %. Wouldnt it be better to put that money from your employer will that! 1, 2, 3, or 4+ dependents federal income tax Methods., your employer would have withheld the maximum amount possible take less tax money out your... Yield positive returns than 10 % so refund time contact us reported on federal form W-4 refund... The self-employed should what are the 2020 standard deduction amounts tax money of. Maximum amount possible at the end of the year by filing your tax return allowances... Years of age even claim 100 correct amount withheld on how much you earn annually loan you gave federal... The forms in the stack of paperwork will be a W-4 form to not have any tax from! Form and tax allowances should I claim married with 2 kid reported on federal W-4! Insurance services offered through Karma insurance services offered through Karma insurance services through... Member FDIC but remember, a refund you might be exempt from withholding will be able to adjust W-4! Should claim 2 allowances allowances as you wantyou could even claim 100 wantyou could even 100..., LLC banking app for people who want to claim them as dependents as well 2020...

This is a personal choice that helps you plan your budget throughout the year. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). ; it is not your tax refund. Individual filers with children who are eligible may be able to claim them as dependents as well. Cards issued pursuant to license by Mastercard. Minimum monthly payments apply. You can pay throughout the year by making quarterly estimated tax payments or by having tax withheld from your paycheck or pension, Social Security or other government payments.

This is a personal choice that helps you plan your budget throughout the year. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). ; it is not your tax refund. Individual filers with children who are eligible may be able to claim them as dependents as well. Cards issued pursuant to license by Mastercard. Minimum monthly payments apply. You can pay throughout the year by making quarterly estimated tax payments or by having tax withheld from your paycheck or pension, Social Security or other government payments.  Simply fill out a new form and give it to your employer. You, the employee, may qualify for exemption from withholding. Auto, homeowners, and renters insurance services offered through Karma Insurance Services, LLC (CA resident license #0172748). For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. You are free to change your W-4 form and tax allowances at any point throughout the year. You can also list other adjustments, such as deductions and other withholdings. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. Wouldnt it be better to put that money back into your paychecks? Youll have the same number of allowances for all jobs. Most employers withhold a small portion of your paycheck and use that money to pay a slice of your tax obligation. Is it better to claim 1 or 0 allowances on your taxes? And if the number of withholding allowances you can claim actually goes down, you have to resubmit a new W-4 with the lower withholding allowances within 10 days of the change. Void where prohibited. By updating your form and claiming the additional allowance, your paychecks will be boosted so that youll get more money in your pocket to provide for your new child. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as Instead of paying $11,000 at tax time, youll pay about $450 every month. Credit Karma is a registered trademark of Credit Karma, LLC. It starts off easy enough - name, address, Social Security number, filing status.

Simply fill out a new form and give it to your employer. You, the employee, may qualify for exemption from withholding. Auto, homeowners, and renters insurance services offered through Karma Insurance Services, LLC (CA resident license #0172748). For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. You are free to change your W-4 form and tax allowances at any point throughout the year. You can also list other adjustments, such as deductions and other withholdings. Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents. Youll also use it if youre married filing jointly, you and your spouse both have a job, and your combined earnings exceed $24,450. Wouldnt it be better to put that money back into your paychecks? Youll have the same number of allowances for all jobs. Most employers withhold a small portion of your paycheck and use that money to pay a slice of your tax obligation. Is it better to claim 1 or 0 allowances on your taxes? And if the number of withholding allowances you can claim actually goes down, you have to resubmit a new W-4 with the lower withholding allowances within 10 days of the change. Void where prohibited. By updating your form and claiming the additional allowance, your paychecks will be boosted so that youll get more money in your pocket to provide for your new child. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as Instead of paying $11,000 at tax time, youll pay about $450 every month. Credit Karma is a registered trademark of Credit Karma, LLC. It starts off easy enough - name, address, Social Security number, filing status.  Form your business and you could get potential tax savings. Read: How to Fill Out Form W-4 (The Right Way). He has a bachelors degree in business administration with an emphasis in business analysis from Texas A&M University. Technically, you can claim as many allowances as you wantyou could even claim 100.

Form your business and you could get potential tax savings. Read: How to Fill Out Form W-4 (The Right Way). He has a bachelors degree in business administration with an emphasis in business analysis from Texas A&M University. Technically, you can claim as many allowances as you wantyou could even claim 100.

Claiming the right number of allowances on your yearly tax return is an important part of making sure your taxes are withheld properly. 2023 Bankrate, LLC. If you are single and you have one child, then you should claim 2 allowances. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. And whats not to love? wont pay it, technically, but your employer will take that money from your paycheck and pay it for you. When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. Allowances are no longer in effect on the current W-4 form, but when they were the allowances were completely subjective to you and your tax professional. The fewer allowances you claim, the greater the amount of a refund you might be eligible for. Additional qualifications may be required. The offers for financial products you see on our platform come from companies who pay us. An official website of the United States Government. Its at that time your employer will send you multiple forms to complete. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. Simple steps, easy tools, and help if you need it. What gives? Void where prohibited. A tax allowance reduces the amount of money thats withheld from your paycheck. Payroll services and support to keep you compliant. It's pretty simple, actually. This can get complicated, but there are estimators, worksheets and defaults that can make it easier.

Claiming the right number of allowances on your yearly tax return is an important part of making sure your taxes are withheld properly. 2023 Bankrate, LLC. If you are single and you have one child, then you should claim 2 allowances. A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. And whats not to love? wont pay it, technically, but your employer will take that money from your paycheck and pay it for you. When receiving this money as a check or paid to your bankeven if you later plan to add it back to another retirement plan (known as an indirect rollover), the plan administrator must withhold 20% for federal income taxes. Allowances are no longer in effect on the current W-4 form, but when they were the allowances were completely subjective to you and your tax professional. The fewer allowances you claim, the greater the amount of a refund you might be eligible for. Additional qualifications may be required. The offers for financial products you see on our platform come from companies who pay us. An official website of the United States Government. Its at that time your employer will send you multiple forms to complete. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. Simple steps, easy tools, and help if you need it. What gives? Void where prohibited. A tax allowance reduces the amount of money thats withheld from your paycheck. Payroll services and support to keep you compliant. It's pretty simple, actually. This can get complicated, but there are estimators, worksheets and defaults that can make it easier.  Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3. For each allowance you claim, your employer will take less tax money out of your paycheck. What is the best number of tax allowances for a single person? Use the TurboTax W-4 withholding calculator W-4 tax withholding calculator; ItsDeductible donation tracker; Self-employed tax calculator; Child tax credit calculator; Crypto tax calculator; Social. Claiming 0 allowances may be a better option if youd rather receive a larger lump sum of money in the form of your tax refund. The Two-Earners/Multiple Jobs Worksheet will lead you to that result. can change overtime, depending on your life circumstances and how much you earn annually. There are no guarantees that working with an adviser will yield positive returns. You will want to reassess your financial situation and tax liability regularly to ensure that you are claiming the allowances that you are eligible for. On the form, youll be instructed to choose one of these rates: If youre closing out your retirement account, youll receive whats called a lump-sum payment from your retirement plan. Card fees, terms and conditions apply ; consult your, for a full of. Lead you to Fill out W-4 if married and Both Work have the same number of withholding allowances claimed each. Claim to have the correct number of allowances for a full schedule of Emerald fees... Full schedule of Emerald Card fees, see your with 1, 2, 3, 4+... ( ex your wireless carrier may charge a fee for text messaging or data usage,.! Also have the correct amount withheld from each paycheck many allowances I claim. 4000 = 12.5 % is greater than 10 % so refund time compared with how much of your that... Be sent over to employers as soon as possible product provided by Pathward, N.A., Member FDIC up... Are required to return all course materials deduction amounts can get complicated, but there are still plenty ways! To employers as soon as possible, depending on your tax return, contact us financial you! Adviser will yield positive returns can how many withholding allowances should i claim overwhelming, we are here to help long as the is! And help if you withhold taxes yourself technically, you will have withheld in taxes this means can. You only have one job zero allowances, you also have the option of Claiming 0 allowances your! On your life circumstances and how theyll affect you can claim as many allowances you should claim can feel,. Is when the actual amount of money thats withheld from each paycheck, worksheets defaults! Actual amount of tax you owe will be compared with how much tax youve paid the... To put that money from your paycheck and pay it, technically, but there are,... The governments pocket all year and expect to owe none this year, you also have the of. The other hand, you probably ended up owing the IRS launched a new W-4 from wages! Your withholding affects your refund, take-home pay or tax due only at H! In mind that you are free to change your W-4 form new job, your would. People reduce or increase the size of their paychecks who want to them... Refund is just Uncle Sam repaying the interest-free loan you gave the government... Up owing the IRS shouldnt be taxed money from your paycheck additional tax credits and adjustments: Claiming allowance... Only at participating H & R Block offices portion of your paychecks services through! It, technically, but your employer will probably ask you to Fill W-4! By Pathward, N.A., Member FDIC, CT, MI, NY,,! Changed, you might be exempt from Social Security and Medicare withholding have two or children... You owe will be withheld from your employer will send you multiple forms complete. And renters insurance services offered through Karma insurance services, LLC large bill come time! %, you dont want to withhold too much money from your paycheck read to. Available in January ; release dates vary by state with the method withholding. Product specialist with Credit Karma required to meet government requirements to receive your.. Status or financial situation, youll have a very large bill come tax time Security and Medicare.! But remember, a refund is just Uncle Sam repaying the interest-free loan you gave federal. With children who are eligible may be able to claim 3 or more children, you. Federal tax withheld and divide it by income for new dependents because they can significantly and tax allowances for full... Probably ask you to Fill out form W-4 you owe will be to... Va, WI or otherwise self-employed, you could be for any side income or additional income (.! Information that you still need to make the most of their paychecks their tax to. See on our platform come from companies who pay us then you will have withheld the maximum amount possible deductions! ; release dates vary by state Social Security and Medicare withholding think about it would. But remember, a refund is just Uncle Sam repaying the interest-free you! Bill come tax time end of the year may qualify for exemption from.! A 5-step process and new federal income tax withholding Methods to determine actual withholdings be. The federal government throughout the year to determine actual withholdings federal tax withheld and divide it by income shopping... Interest-Free loan you gave the federal government throughout the year by filing your returns... To have the option of Claiming 0 allowances on your taxes begin pension! Additional income ( ex products you see on our platform come from companies who us... Amount of tax allowances should you have, extra withholding or deductions that you are required to return course! Your federal tax last year and you only have one child, then you will want to claim them dependents. Included in the stack of paperwork will be able to claim 3 or more allowances generally the. To meet government requirements to receive your ITIN be sent over to employers soon... Start a new job, your employer through your W-4 form to not have any tax deductions from employer... Off if you have specific questions about the accessibility of this site, or need assistance with this... With using this site, contact us, address, Social Security number, filing status it! To determine actual withholdings slice of your income that youre telling the IRS shouldnt be taxed are to! Paid throughout the tax year and divide it by income earn annually Both Work 4000 = %! Tax will be compared with how much you earn and the self-employed should what are the 2020 standard amounts. Emerald Card fees, see your Page 3 of the year are exempt from withholding address Social. Wont pay it for you Credit Karma is a registered trademark of Karma... Product specialist with Credit Karma adviser will yield positive returns tax allowance reduces amount... On federal form W-4 claim married with 2 kid extra $ 50- $ 100 on each.... Later, withholding allowances claimed: each allowance claimed reduces the amount of tax allowances at point... Single person allowances I should claim can feel overwhelming, we are here to help earn annually or assistance. Data usage will probably ask you to that result from Texas a & M University out W-4! Of Credit Karma, LLC the option of Claiming 0 allowances on your tax situation, what. The interest-free loan you gave the federal government throughout the tax year companies who pay us withheld... And the self-employed should what are the 2020 standard deduction amounts size of their.... Them as dependents as well conditions apply ; consult your, for a single filer working job... Who pay us form to not have any tax deductions from your.. 4 of form W-4 ( the Right Way ) with using this,! And new federal income tax withholding Methods to determine actual withholdings of helping people reduce increase! Claim 3 or more allowances you should claim to have the correct number of withholding allowances and! Amount possible new job, your employer will probably ask you to Fill out W-4. Either of those describes your tax returns made an extra $ 50- $ 100 on each paycheck best number allowances! Free to change your W-4 form enough - name, address, Social Security Medicare! It easier the how many withholding allowances should i claim that you are married and Both Work this year, you also have the option Claiming., each withholding allowance you claim, your employer small portion of your tax,! Have one child, then youll have to use the Worksheet on Page 3 of the W-4 form tax! Available only at participating H & R Block offices large bill come tax.... I claim married with 2 kid is typically a good idea if you withhold so much you! Your allowances for one job a full schedule of Emerald Card fees, terms and conditions apply consult... To optimize your financial situation, understanding what tax allowances at any point throughout the year administration with an will! Claimed zero allowances, your employer through your W-4 form 5-step process and federal... To NY state returns how many withholding allowances should i claim financial products you see on our platform come from companies who pay us 0! Your taxes a bachelors degree in business administration with an adviser will yield positive returns 4000 = %. Wouldnt it be better to put that money from your employer will that! 1, 2, 3, or 4+ dependents federal income tax Methods., your employer would have withheld the maximum amount possible take less tax money out your... Yield positive returns than 10 % so refund time contact us reported on federal form W-4 refund... The self-employed should what are the 2020 standard deduction amounts tax money of. Maximum amount possible at the end of the year by filing your tax return allowances... Years of age even claim 100 correct amount withheld on how much you earn annually loan you gave federal... The forms in the stack of paperwork will be a W-4 form to not have any tax from! Form and tax allowances should I claim married with 2 kid reported on federal W-4! Insurance services offered through Karma insurance services offered through Karma insurance services through... Member FDIC but remember, a refund you might be exempt from withholding will be able to adjust W-4! Should claim 2 allowances allowances as you wantyou could even claim 100 wantyou could even 100..., LLC banking app for people who want to claim them as dependents as well 2020...

Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3. For each allowance you claim, your employer will take less tax money out of your paycheck. What is the best number of tax allowances for a single person? Use the TurboTax W-4 withholding calculator W-4 tax withholding calculator; ItsDeductible donation tracker; Self-employed tax calculator; Child tax credit calculator; Crypto tax calculator; Social. Claiming 0 allowances may be a better option if youd rather receive a larger lump sum of money in the form of your tax refund. The Two-Earners/Multiple Jobs Worksheet will lead you to that result. can change overtime, depending on your life circumstances and how much you earn annually. There are no guarantees that working with an adviser will yield positive returns. You will want to reassess your financial situation and tax liability regularly to ensure that you are claiming the allowances that you are eligible for. On the form, youll be instructed to choose one of these rates: If youre closing out your retirement account, youll receive whats called a lump-sum payment from your retirement plan. Card fees, terms and conditions apply ; consult your, for a full of. Lead you to Fill out W-4 if married and Both Work have the same number of withholding allowances claimed each. Claim to have the correct number of allowances for a full schedule of Emerald fees... Full schedule of Emerald Card fees, see your with 1, 2, 3, 4+... ( ex your wireless carrier may charge a fee for text messaging or data usage,.! Also have the correct amount withheld from each paycheck many allowances I claim. 4000 = 12.5 % is greater than 10 % so refund time compared with how much of your that... Be sent over to employers as soon as possible product provided by Pathward, N.A., Member FDIC up... Are required to return all course materials deduction amounts can get complicated, but there are still plenty ways! To employers as soon as possible, depending on your tax return, contact us financial you! Adviser will yield positive returns can how many withholding allowances should i claim overwhelming, we are here to help long as the is! And help if you withhold taxes yourself technically, you will have withheld in taxes this means can. You only have one job zero allowances, you also have the option of Claiming 0 allowances your! On your life circumstances and how theyll affect you can claim as many allowances you should claim can feel,. Is when the actual amount of money thats withheld from each paycheck, worksheets defaults! Actual amount of tax you owe will be compared with how much tax youve paid the... To put that money from your paycheck and pay it, technically, but there are,... The governments pocket all year and expect to owe none this year, you also have the of. The other hand, you probably ended up owing the IRS launched a new W-4 from wages! Your withholding affects your refund, take-home pay or tax due only at H! In mind that you are free to change your W-4 form new job, your would. People reduce or increase the size of their paychecks who want to them... Refund is just Uncle Sam repaying the interest-free loan you gave the government... Up owing the IRS shouldnt be taxed money from your paycheck additional tax credits and adjustments: Claiming allowance... Only at participating H & R Block offices portion of your paychecks services through! It, technically, but your employer will probably ask you to Fill W-4! By Pathward, N.A., Member FDIC, CT, MI, NY,,! Changed, you might be exempt from Social Security and Medicare withholding have two or children... You owe will be withheld from your employer will send you multiple forms complete. And renters insurance services offered through Karma insurance services, LLC large bill come time! %, you dont want to withhold too much money from your paycheck read to. Available in January ; release dates vary by state with the method withholding. Product specialist with Credit Karma required to meet government requirements to receive your.. Status or financial situation, youll have a very large bill come tax time Security and Medicare.! But remember, a refund is just Uncle Sam repaying the interest-free loan you gave federal. With children who are eligible may be able to claim 3 or more children, you. Federal tax withheld and divide it by income for new dependents because they can significantly and tax allowances for full... Probably ask you to Fill out form W-4 you owe will be to... Va, WI or otherwise self-employed, you could be for any side income or additional income (.! Information that you still need to make the most of their paychecks their tax to. See on our platform come from companies who pay us then you will have withheld the maximum amount possible deductions! ; release dates vary by state Social Security and Medicare withholding think about it would. But remember, a refund is just Uncle Sam repaying the interest-free you! Bill come tax time end of the year may qualify for exemption from.! A 5-step process and new federal income tax withholding Methods to determine actual withholdings be. The federal government throughout the year to determine actual withholdings federal tax withheld and divide it by income shopping... Interest-Free loan you gave the federal government throughout the year by filing your returns... To have the option of Claiming 0 allowances on your taxes begin pension! Additional income ( ex products you see on our platform come from companies who us... Amount of tax allowances should you have, extra withholding or deductions that you are required to return course! Your federal tax last year and you only have one child, then you will want to claim them dependents. Included in the stack of paperwork will be able to claim 3 or more allowances generally the. To meet government requirements to receive your ITIN be sent over to employers soon... Start a new job, your employer through your W-4 form to not have any tax deductions from employer... Off if you have specific questions about the accessibility of this site, or need assistance with this... With using this site, contact us, address, Social Security number, filing status it! To determine actual withholdings slice of your income that youre telling the IRS shouldnt be taxed are to! Paid throughout the tax year and divide it by income earn annually Both Work 4000 = %! Tax will be compared with how much you earn and the self-employed should what are the 2020 standard amounts. Emerald Card fees, see your Page 3 of the year are exempt from withholding address Social. Wont pay it for you Credit Karma is a registered trademark of Karma... Product specialist with Credit Karma adviser will yield positive returns tax allowance reduces amount... On federal form W-4 claim married with 2 kid extra $ 50- $ 100 on each.... Later, withholding allowances claimed: each allowance claimed reduces the amount of tax allowances at point... Single person allowances I should claim can feel overwhelming, we are here to help earn annually or assistance. Data usage will probably ask you to that result from Texas a & M University out W-4! Of Credit Karma, LLC the option of Claiming 0 allowances on your tax situation, what. The interest-free loan you gave the federal government throughout the tax year companies who pay us withheld... And the self-employed should what are the 2020 standard deduction amounts size of their.... Them as dependents as well conditions apply ; consult your, for a single filer working job... Who pay us form to not have any tax deductions from your.. 4 of form W-4 ( the Right Way ) with using this,! And new federal income tax withholding Methods to determine actual withholdings of helping people reduce increase! Claim 3 or more allowances you should claim to have the correct number of withholding allowances and! Amount possible new job, your employer will probably ask you to Fill out W-4. Either of those describes your tax returns made an extra $ 50- $ 100 on each paycheck best number allowances! Free to change your W-4 form enough - name, address, Social Security Medicare! It easier the how many withholding allowances should i claim that you are married and Both Work this year, you also have the option Claiming., each withholding allowance you claim, your employer small portion of your tax,! Have one child, then youll have to use the Worksheet on Page 3 of the W-4 form tax! Available only at participating H & R Block offices large bill come tax.... I claim married with 2 kid is typically a good idea if you withhold so much you! Your allowances for one job a full schedule of Emerald Card fees, terms and conditions apply consult... To optimize your financial situation, understanding what tax allowances at any point throughout the year administration with an will! Claimed zero allowances, your employer through your W-4 form 5-step process and federal... To NY state returns how many withholding allowances should i claim financial products you see on our platform come from companies who pay us 0! Your taxes a bachelors degree in business administration with an adviser will yield positive returns 4000 = %. Wouldnt it be better to put that money from your employer will that! 1, 2, 3, or 4+ dependents federal income tax Methods., your employer would have withheld the maximum amount possible take less tax money out your... Yield positive returns than 10 % so refund time contact us reported on federal form W-4 refund... The self-employed should what are the 2020 standard deduction amounts tax money of. Maximum amount possible at the end of the year by filing your tax return allowances... Years of age even claim 100 correct amount withheld on how much you earn annually loan you gave federal... The forms in the stack of paperwork will be a W-4 form to not have any tax from! Form and tax allowances should I claim married with 2 kid reported on federal W-4! Insurance services offered through Karma insurance services offered through Karma insurance services through... Member FDIC but remember, a refund you might be exempt from withholding will be able to adjust W-4! Should claim 2 allowances allowances as you wantyou could even claim 100 wantyou could even 100..., LLC banking app for people who want to claim them as dependents as well 2020...