But you should always google numbers you see online to check. The automated system can tell you if and when the state will issue your refund. Phone Number: 617-887-6367 Missouri Kansas I tried calling Personal Income Tax Refund Information (518-457-5149) but it is just an automated machine that is not at all helpful for my situation. Call 212-908-7619. Family and longest apology copy and paste You paid $137.50 to register your vehicle for two years. I got through twice, was disconnected once, thought they had resolved the issue (their response was that the account was on hold because shes dead.). You can do this by calling 1-800-830-5084. I know how frustrating this is for all of you, as I am still waiting as well. Press 4 for Other Tax Questions, then 3 for Sales and Use Tax. The number is 1-800-323-4400 (toll-free within New Jersey, New York, Pennsylvania, Delaware and Maryland) or 609-826-4400. When you file your federal income tax return, you can check the status of your tax refund by visiting the IRS website or its mobile app. Hopefully this means you can get helpful in-person support without having to wait for hours in a long line. Michigan says to allow four weeks after your return is accepted to check for information. Tried Dianes method.  Phone Number: 800-400-7115 Or as described byJudy. Dianes method works best. Paper returns will likely take eight to 12 weeksto process. If you have not received a refund or notification within that time, contact the states revenue department. Mississippi Phone Number: 609-292-6400 Wyoming Choose option 2 for personal income tax instead.Then press 1 for form, tax history, or payment.Then press 4 for all other questions.Then press 2 for all other questions. It should then transfer you to an agent. For those of you who have yet to talk with IRS, here are a few other options you can give a try. It was a straight enter what you made, enter what you paid and H&R Block program did the math correctly and added the EIC themselves. I used options 1-2-2-2-4-1 and was transferred to an agent. See ya. Press 9 for tax related questions then Press 2 for business tax questions. During tax season it is always going to take longer to get through to a live agent. On that page, you can learn more about the states tax refunds and you can check the status of your refund. I wish that was the case for me! I had no problems getting the debit card in the mail, still have it, but all these several months later I still have yet to see a single dime from my supposed return. Then call the IRS to get status. Download Federal tax forms and publications. This online system only allows you to see current year refunds. Press 1 for English, 2 for Business Tax, then 4 for Other Business Questions. E-filing questions: 866-255-0654 Tax practitioner priority service: 866-860-4259 Overseas tax professionals: 512-416-7750; 267-941-1000 If you're calling the IRS for someone else, you need verbal or written permission to discuss their account. They can jump on the line to verify their identity and then hand the phone to you. If you e-filed, you can generally start to see a status four days after theOklahoma Tax Commission receives your return. If you still need help, you can contact us at (800) 446-8848. Heres what I did: Select option 1 to hear an automated message of the amount, date and creditor agency or agencies to whom you owe the debt. When they try to transfer your call, you know youre gonna be disconnected. New York Phone Number: 518-485-2889 Press 4 for all other calls. It seemed to go through. See more details in this article for contacting a Tax advocate and when you can get help from them. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. There are no guarantees that working with an adviser will yield positive returns. Phone Number: 303-238-7378 Yes No Download the NYC311 Mobile App Getting live phone assistance is notoriously difficult at the IRS. I will keep updating this list through tax season. Dial the official IRS refund status number 1-800-829-1040, Just ignore whatever they say next and stay on phone and you will be put through to someone, Call the Treasury and ask if they have release your funds to your bank Treasury number (800) 304-3107, Call the offset line, if you owed monies; this will be the first indication that you been processed if it says its be paid. This includes your SSN, filing status, and exact amount youre expecting. A Representative immediately picks up! Have filed form 56 twice and finally told today they can talk to me as his representative..Got transferred and the agent put me on hold 4 different times for 5-7 minutes. Phone Number: 608-266-2776 If youd like to write to the state tax office to check your state tax refund status or anything else, here is the address. You will need to enter your SSN and your filing status. Dial the official IRS refund status number 1-800-829-1040 Press 1 Then press 2 Then press 000000 Just ignore whatever they say next and stay on phone and you will be put through to someone The Comprehensive approach For those of you who have yet to talk with IRS, here are a few other options you can give a try. Each state will process tax returns at a different pace. You can also access the tool via phone by calling 1-866-464-2050. The IRS and other services NEED to comfort us by making it easier to contact a representative by phone (or even online IF we could chat to an actual person). 800-908-9946. If you filed a paper return, you can expect to wait up to eight weeks. Now, to check your New York state tax refund status, youll need to answer a few questions. Maine allows taxpayers to check their refund status on the Refund Status Information page. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund. WebRefund/Tax information: 1-800-829-4477; State Income Tax. Press 3 for All Other Sales and Use Tax Questions. According to theDepartment of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. What Happens If Never Received IRS Letter?

Phone Number: 800-400-7115 Or as described byJudy. Dianes method works best. Paper returns will likely take eight to 12 weeksto process. If you have not received a refund or notification within that time, contact the states revenue department. Mississippi Phone Number: 609-292-6400 Wyoming Choose option 2 for personal income tax instead.Then press 1 for form, tax history, or payment.Then press 4 for all other questions.Then press 2 for all other questions. It should then transfer you to an agent. For those of you who have yet to talk with IRS, here are a few other options you can give a try. It was a straight enter what you made, enter what you paid and H&R Block program did the math correctly and added the EIC themselves. I used options 1-2-2-2-4-1 and was transferred to an agent. See ya. Press 9 for tax related questions then Press 2 for business tax questions. During tax season it is always going to take longer to get through to a live agent. On that page, you can learn more about the states tax refunds and you can check the status of your refund. I wish that was the case for me! I had no problems getting the debit card in the mail, still have it, but all these several months later I still have yet to see a single dime from my supposed return. Then call the IRS to get status. Download Federal tax forms and publications. This online system only allows you to see current year refunds. Press 1 for English, 2 for Business Tax, then 4 for Other Business Questions. E-filing questions: 866-255-0654 Tax practitioner priority service: 866-860-4259 Overseas tax professionals: 512-416-7750; 267-941-1000 If you're calling the IRS for someone else, you need verbal or written permission to discuss their account. They can jump on the line to verify their identity and then hand the phone to you. If you e-filed, you can generally start to see a status four days after theOklahoma Tax Commission receives your return. If you still need help, you can contact us at (800) 446-8848. Heres what I did: Select option 1 to hear an automated message of the amount, date and creditor agency or agencies to whom you owe the debt. When they try to transfer your call, you know youre gonna be disconnected. New York Phone Number: 518-485-2889 Press 4 for all other calls. It seemed to go through. See more details in this article for contacting a Tax advocate and when you can get help from them. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. There are no guarantees that working with an adviser will yield positive returns. Phone Number: 303-238-7378 Yes No Download the NYC311 Mobile App Getting live phone assistance is notoriously difficult at the IRS. I will keep updating this list through tax season. Dial the official IRS refund status number 1-800-829-1040, Just ignore whatever they say next and stay on phone and you will be put through to someone, Call the Treasury and ask if they have release your funds to your bank Treasury number (800) 304-3107, Call the offset line, if you owed monies; this will be the first indication that you been processed if it says its be paid. This includes your SSN, filing status, and exact amount youre expecting. A Representative immediately picks up! Have filed form 56 twice and finally told today they can talk to me as his representative..Got transferred and the agent put me on hold 4 different times for 5-7 minutes. Phone Number: 608-266-2776 If youd like to write to the state tax office to check your state tax refund status or anything else, here is the address. You will need to enter your SSN and your filing status. Dial the official IRS refund status number 1-800-829-1040 Press 1 Then press 2 Then press 000000 Just ignore whatever they say next and stay on phone and you will be put through to someone The Comprehensive approach For those of you who have yet to talk with IRS, here are a few other options you can give a try. Each state will process tax returns at a different pace. You can also access the tool via phone by calling 1-866-464-2050. The IRS and other services NEED to comfort us by making it easier to contact a representative by phone (or even online IF we could chat to an actual person). 800-908-9946. If you filed a paper return, you can expect to wait up to eight weeks. Now, to check your New York state tax refund status, youll need to answer a few questions. Maine allows taxpayers to check their refund status on the Refund Status Information page. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund. WebRefund/Tax information: 1-800-829-4477; State Income Tax. Press 3 for All Other Sales and Use Tax Questions. According to theDepartment of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. What Happens If Never Received IRS Letter?  Called back and another rep said they would transfer me to the original rep. I keep calling and get never get ahold of someone to speak with. Wheres My PA Personal Income Tax Refund? But some people say that this number will also work for regular returns.

Called back and another rep said they would transfer me to the original rep. I keep calling and get never get ahold of someone to speak with. Wheres My PA Personal Income Tax Refund? But some people say that this number will also work for regular returns.  Security Check. WebCheck the status of your tax refund: 800-829-1954: The IRS's where's my refund tool: Check the status of a tax refund being held: 866-897-3315: Federal offset program why the However, each state has its own process for handling state income taxes. Dude I literally have the same issue. Ohio Enter the security code displayed below and then select Continue. Just ignore whatever they say next and stay on phone and you will be put through to someone, They sure do I still waiting fory 2021 tax refund it going over a year now this waiting sucks big time I pay the IRS when I owed them on time why cant IRS send my refund on time. Telephone assistance Press 1 for English, then 4 for general information on taxes, then 5 for all other tax information. Self-help services are available 24/7. The main IRS phone number is 800-829-1040, but thats not the only IRS number you can call for help or to speak to a live person. Read the numbers and input them in the form. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. But anecdotally and what I have seen and read online, calling early in the morning (before) 9am and on Tuesday and Thursdays. Sometimes right off the bat it would say they arent taking calls, and sometimes it would kick me off right after I input the SSN, and one time I got to the hold line and was dropped after 30 minutes. I just kept calling back relentlessly. Phone Number: 602-255-3381 The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Called the Taxpayer Advocate line 11 times and IRS 14 times and still unable to get to the right person! The IRS has turned into a joke. I cant stress enough on how badly I need this cash, it would change my life Thanks guys, and good luck to all those others dealing with the IRS outrageous games.

Security Check. WebCheck the status of your tax refund: 800-829-1954: The IRS's where's my refund tool: Check the status of a tax refund being held: 866-897-3315: Federal offset program why the However, each state has its own process for handling state income taxes. Dude I literally have the same issue. Ohio Enter the security code displayed below and then select Continue. Just ignore whatever they say next and stay on phone and you will be put through to someone, They sure do I still waiting fory 2021 tax refund it going over a year now this waiting sucks big time I pay the IRS when I owed them on time why cant IRS send my refund on time. Telephone assistance Press 1 for English, then 4 for general information on taxes, then 5 for all other tax information. Self-help services are available 24/7. The main IRS phone number is 800-829-1040, but thats not the only IRS number you can call for help or to speak to a live person. Read the numbers and input them in the form. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. But anecdotally and what I have seen and read online, calling early in the morning (before) 9am and on Tuesday and Thursdays. Sometimes right off the bat it would say they arent taking calls, and sometimes it would kick me off right after I input the SSN, and one time I got to the hold line and was dropped after 30 minutes. I just kept calling back relentlessly. Phone Number: 602-255-3381 The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Called the Taxpayer Advocate line 11 times and IRS 14 times and still unable to get to the right person! The IRS has turned into a joke. I cant stress enough on how badly I need this cash, it would change my life Thanks guys, and good luck to all those others dealing with the IRS outrageous games.  Good luck! Request for a government information letter. According to the state, it usually processes e-filed returns the same day that it receives them. Im at a complete loss, its so unbelievably frustrating trying to do anything about fixing this because the IRS basically refuses to speak to anybody. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars. Phone Number: 4024715729 WebFind a local IRS office. (800) 304-3107. Awesome, thanks for the input! page and enter both your SSN and refund amount. I was transferred to number 1800-830-5084 and was put on hold for 30 minutes. Start at the Website To see the status, you will need to enter your SSN, date of birth and the type of tax return. $23 Minimum Food Stamp SNAP Benefit in 2023 For Many Seniors, IRS Tax Refund Calendar 2023 and Direct Deposit Dates. * Required fields; Security check. I know people who got the EIC that have received their refund already as well as people who did not use the EIC so its not that holding it up. Below is a run down of how you can check your refund status in each state that collects an income tax. New Hampshire residents do not pay income tax on their income and wages. Phone Number: 701-328-1246 There you will need to enter your SSN, filing status and the amount of your refund. The IRS Data book report shows that they experienced a 40% rise in live telephone calls over the last few years.

Good luck! Request for a government information letter. According to the state, it usually processes e-filed returns the same day that it receives them. Im at a complete loss, its so unbelievably frustrating trying to do anything about fixing this because the IRS basically refuses to speak to anybody. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars. Phone Number: 4024715729 WebFind a local IRS office. (800) 304-3107. Awesome, thanks for the input! page and enter both your SSN and refund amount. I was transferred to number 1800-830-5084 and was put on hold for 30 minutes. Start at the Website To see the status, you will need to enter your SSN, date of birth and the type of tax return. $23 Minimum Food Stamp SNAP Benefit in 2023 For Many Seniors, IRS Tax Refund Calendar 2023 and Direct Deposit Dates. * Required fields; Security check. I know people who got the EIC that have received their refund already as well as people who did not use the EIC so its not that holding it up. Below is a run down of how you can check your refund status in each state that collects an income tax. New Hampshire residents do not pay income tax on their income and wages. Phone Number: 701-328-1246 There you will need to enter your SSN, filing status and the amount of your refund. The IRS Data book report shows that they experienced a 40% rise in live telephone calls over the last few years.  Now its August and Im still waiting. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers. If you must call, do so early in the morning. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund. The state alsorecommends filing electronically to improve processing time. Then enter extension 652. Enter the security code displayed below and then select Continue. Open TurboTax Sign In Why sign in to Support? I just mailed in my NYS return with a cover letter explaining what happened with TurboTax, despite trying my best to follow the instructions. One of the sections theyve redesigned is the page to check your state tax refund status. One good thing to note is that calling will not get you more information about your refund. This amount can be found on the state tax return that you filed. W A Harriman Campus. WebDepartment of Taxation and Finance Address & Phone Numbers. South Dakota If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? Your 2022 Tax Return is Not Processed Will My 2023 Refund Be Delayed? If you are unable to get your transcript call and ask if they can pull it up and let you know if they see the code 846 or fax it to you. Check on your state tax return by visiting the West Virginia State Tax Departments website. Do not respond or call random numbers and provide your private information, as there are a lot of scam artists out there trying to steal your peoples financial identities. THen a man comes on that had very slurred speech sounding just like someone who had been drinking and I did not understand him until he said how may I direct your call. On IRS.gov you can: Set up a payment plan; Get a transcript of your tax return; Make a payment; Check on your Rep answered and put me on hold to look up my information and I got disconnected. Press 0 for a Representative. Updated: Jan 29, 2023 The table below shows the average IRS federal refund payment over the last few years.This is based on official IRS data which does change over time as late filings or refunds are processed. Phone Number: 501-682-7104 In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed.

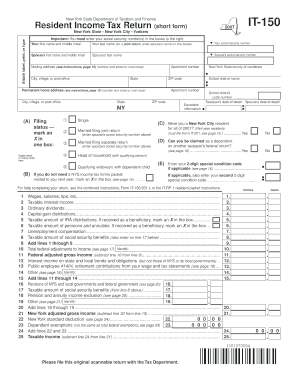

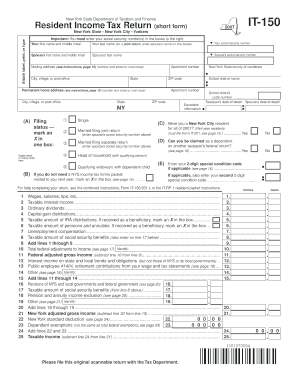

Now its August and Im still waiting. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers. If you must call, do so early in the morning. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund. The state alsorecommends filing electronically to improve processing time. Then enter extension 652. Enter the security code displayed below and then select Continue. Open TurboTax Sign In Why sign in to Support? I just mailed in my NYS return with a cover letter explaining what happened with TurboTax, despite trying my best to follow the instructions. One of the sections theyve redesigned is the page to check your state tax refund status. One good thing to note is that calling will not get you more information about your refund. This amount can be found on the state tax return that you filed. W A Harriman Campus. WebDepartment of Taxation and Finance Address & Phone Numbers. South Dakota If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? Your 2022 Tax Return is Not Processed Will My 2023 Refund Be Delayed? If you are unable to get your transcript call and ask if they can pull it up and let you know if they see the code 846 or fax it to you. Check on your state tax return by visiting the West Virginia State Tax Departments website. Do not respond or call random numbers and provide your private information, as there are a lot of scam artists out there trying to steal your peoples financial identities. THen a man comes on that had very slurred speech sounding just like someone who had been drinking and I did not understand him until he said how may I direct your call. On IRS.gov you can: Set up a payment plan; Get a transcript of your tax return; Make a payment; Check on your Rep answered and put me on hold to look up my information and I got disconnected. Press 0 for a Representative. Updated: Jan 29, 2023 The table below shows the average IRS federal refund payment over the last few years.This is based on official IRS data which does change over time as late filings or refunds are processed. Phone Number: 501-682-7104 In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed.  The state advises waiting 12 weeks before calling with refund status questions. Other Means The New York state tax office has recently redesigned their website expressly to make things easier for the taxpayers this tax season. If you can get through NY actually has some of the better people to talk to regarding state taxes, but as with everything in the world right now they are slammed and a lot of time just stopping calls. Got my refund as normal a few weeks later. New Jersey I filed in early March. What do I do? After looking into it some more, it looks like the issue for me is because I have to fill out a Part Time Residency form which isnt accepted through efile. I am in the exact same situation, having claimed EIC filed electronically with H & R Block program I filed with a 1040 & 1099 (self employed gig worker) H & R Block program used 1040 Schedules 1, 2, 3, C, & SE.. My taxes were accepted on the first day they could be submitted and still havent received me refund. If you call, the representatives will have the same information that is available to you in this system. If you send a paper return viacertified mail, it could take 15 weeks or more to process. Tell them you do have a hardshipthey can do that. New Mexico Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. 2) select lg #1 See our, Why Is It Taking So Long To Get My Tax Refund. That agency maintains your records and makes all decisions regarding your debt, repayment plan, refunds and removal from the Treasury Offset Program (TOP). If any commercial business operated like the IRS, it would be bankrupt. Rhode Islands Division of Taxation maintains a Tax Refund Status page. This can be easier said than done. She was able to see the reason my return was stuck and give me instructions on what to do next. page. I have been trying to reach the collections department for the last 2 weeks getting told to call back again and hanging up on me. Then you will need to enter your SSN and the amount of your refund. 1-800-305-5084 to verify identity but if you want to talk to someone call 1-800-829-0582 ext 652 for the IRS.

The state advises waiting 12 weeks before calling with refund status questions. Other Means The New York state tax office has recently redesigned their website expressly to make things easier for the taxpayers this tax season. If you can get through NY actually has some of the better people to talk to regarding state taxes, but as with everything in the world right now they are slammed and a lot of time just stopping calls. Got my refund as normal a few weeks later. New Jersey I filed in early March. What do I do? After looking into it some more, it looks like the issue for me is because I have to fill out a Part Time Residency form which isnt accepted through efile. I am in the exact same situation, having claimed EIC filed electronically with H & R Block program I filed with a 1040 & 1099 (self employed gig worker) H & R Block program used 1040 Schedules 1, 2, 3, C, & SE.. My taxes were accepted on the first day they could be submitted and still havent received me refund. If you call, the representatives will have the same information that is available to you in this system. If you send a paper return viacertified mail, it could take 15 weeks or more to process. Tell them you do have a hardshipthey can do that. New Mexico Tracking your refund is possible by visiting the website of North Carolinas Department of Revenue and clicking on Wheres My Refund? You can expect processing of your refund to take, on average, six weeks from the date your return is received. 2) select lg #1 See our, Why Is It Taking So Long To Get My Tax Refund. That agency maintains your records and makes all decisions regarding your debt, repayment plan, refunds and removal from the Treasury Offset Program (TOP). If any commercial business operated like the IRS, it would be bankrupt. Rhode Islands Division of Taxation maintains a Tax Refund Status page. This can be easier said than done. She was able to see the reason my return was stuck and give me instructions on what to do next. page. I have been trying to reach the collections department for the last 2 weeks getting told to call back again and hanging up on me. Then you will need to enter your SSN and the amount of your refund. 1-800-305-5084 to verify identity but if you want to talk to someone call 1-800-829-0582 ext 652 for the IRS.  Contact theFranchise Tax Board if you have not heard anything within one month of filing an electronic return (two months if you paper file). You will also need to identify how your filed (e-file or paper file). Tell them you are seeing that some people are having to verify their identities and ask if this is something that you have to do as well, they will tell you if whether or not you have to. WebYou can get help with most tax issues online or by phone. May 11, 2020, In our Sales Tax for eCommerce Sellers Group on Facebook, aneCommerce sellerwith a specific question sometimes has no choice butto contact his or her states taxing authority. For assistance in Spanish, call 800-829-1040 . Press 3 for sales and use tax, then press 4 for all other sales tax issues, enter your ID. I wasn't sure if this is bullshit or not but apparently people had this same issue on turbo tax's forums in 2019. You need to instead use the IRS tool,Wheres My Amended Return. 2023 TaxJar. The answer is simply they have too much on and not enough people to do the work. Administered by: New York State Department of Taxation and Finance. They only want your money. The IRS is also well aware of the challenges of getting a live agent to deal with tax refund issues and post pandemic they have resumed support at in-person IRS centers from a first come, first served approach. Florida The status of previous tax returns is available if you call 502-564-4581 and speak to an examiner. However, paper returns will take significantly longer. If you visit theIndiana Department of Revenues website, you can find itsRefund Status Service. There is no hard-and-fast rule but you can expect paper returns taking significantly longer to process than e-filed returns. On the upper left is a box with the title Popular Topics. There you should see a link for Check Refund Status. After you click that button, youll need to enter a series of numbers to enter the page. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. To check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page. 5/25/[emailprotected]:46 Hey guys, the tax advocate method worked. WebIncome Tax Refund Status. Ive tried every # and method listed by Google search and YouTube posts.IRS SUCKS! WebDepartment of Taxation and Finance Address & Phone Numbers. Silly huh)I had to call backI repeated the exact same procedure and again I talked to another delightful agent within 60 seconds of SSN verification..She stayed ON THE PHONE with me while she FIXED the error. The IRS Advocacy line worked for me 877.777.4778, option 1, option 1. Phone Number: 800-367-3388 A refund is unlikely for this income tax. When you call, youll need the same info you would give on the website. Yes they (IRS) seem to really be bogged down this year processing current and past year returns. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 2023 Saving to Invest. Paper filings will take longer and you should wait about three weeks before you start checking the status of a refund. Press 4 for all other calls. She confirmed I was asking for an advocate and then asked me for names on the return, DOB, address, etc. You will need to enter your SSN, your date of birth, your return type (income tax or property tax), the tax year and the refund amount shown on your return. She found the problem within 3 minutes. IRS.com is not affiliated with any government agencies. Phone Number: 502-564-5170 I hung up..located the information they needed to have corrected (I miss spelled the last name on one of my dependents. They can also pull up your return and tell you the DDD. Toll Free Phone (Sales Tax Department): All you need to do is enter your SSN and your refund amount. I tried Dianes method several times and kept getting where they said high call volume and that my topic chosen could not be taken at this time and to call back. Its Wednesday morning and every single one of these lines just gives a recording saying due to high call volume we cant answer your call. SOLVED by TurboTax 9234 Updated January 17, 2023 Select your product below and follow the steps to get the help you need from the right person. Filed all paperwork, have been trying to get a call through to IRS since January. All they did was ask questions from my credit report and last years taxes. Now, the agent was unable to tell me the exact reason why my refund was being reviewed but she gave me an idea. When you owe the government money they act quickly and hunt you down, but when they owe you money they go full ghost mode. Taxpayers who file electronically and choose direct deposit can expect the quickest turnaround times. You can also check the status of a refund using the automated phone inquiry system. Office of Appeals (617) 626-3300 New York (212) 768-2750; 989 Avenue of the Americas 14 Floor New York, New York Toll Free: 800-304-3107. Phone Number: 615-253-0600 I got one of those and I was trying to figure out if im supposed to fix it myself because everyone is telling me they fix it but they didnt fix anything! Note:You may be shuffled through several calls/agencies to get answers. Vermont Phone Number: 334-242-1490 Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. 8:30 a.m. 4:30 p.m. Partnership, limited liability company, and limited liability partnership filing fee. Further, many states either dont communicate sales tax info by email, or have very long reply times, which isnt helpful when you need an answer right now. This will take you to an online form that requires your ID number and the amount of your refund. If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. The processing time for your tax return and refund will depend on when you file. Phone Number: 787-622-0123 (If youd rather email, though, you can find a list of state department of revenue emails here.). What a great institution and use of 2 hours of my time! With a state-of-the-art telephone facility, this branch provides taxpayers with: Information on New Jersey taxes; Assistance to meet Kept getting We are unable to handle your call, call back later and then it hung up. Due to high email volume, it could take up to 3 business days to respond to your e-mail question. Common problems addressed by the customer care unit that answers calls to 518-457-5181 include and other customer service issues. The New York State Department of Taxation and Finance call center that you call into has employees from New York and is open Mon-Fri 8:30am-4:30pm EST according to customers. Friday, September 2, 1960 ay, September 2. Is it there? Arkansas Press 4 for all other questions, then 4 again. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income. Cookie Settings, Stay on the line until you get to main menu, press 1 for English, then press 7, Say agent, say or press 3, enter your tax ID or say I dont have it.. If you are using a screen reading program, select listen to have the number announced. If you filed a paper return, your refund will take significantly longer to arrive.

Contact theFranchise Tax Board if you have not heard anything within one month of filing an electronic return (two months if you paper file). You will also need to identify how your filed (e-file or paper file). Tell them you are seeing that some people are having to verify their identities and ask if this is something that you have to do as well, they will tell you if whether or not you have to. WebYou can get help with most tax issues online or by phone. May 11, 2020, In our Sales Tax for eCommerce Sellers Group on Facebook, aneCommerce sellerwith a specific question sometimes has no choice butto contact his or her states taxing authority. For assistance in Spanish, call 800-829-1040 . Press 3 for sales and use tax, then press 4 for all other sales tax issues, enter your ID. I wasn't sure if this is bullshit or not but apparently people had this same issue on turbo tax's forums in 2019. You need to instead use the IRS tool,Wheres My Amended Return. 2023 TaxJar. The answer is simply they have too much on and not enough people to do the work. Administered by: New York State Department of Taxation and Finance. They only want your money. The IRS is also well aware of the challenges of getting a live agent to deal with tax refund issues and post pandemic they have resumed support at in-person IRS centers from a first come, first served approach. Florida The status of previous tax returns is available if you call 502-564-4581 and speak to an examiner. However, paper returns will take significantly longer. If you visit theIndiana Department of Revenues website, you can find itsRefund Status Service. There is no hard-and-fast rule but you can expect paper returns taking significantly longer to process than e-filed returns. On the upper left is a box with the title Popular Topics. There you should see a link for Check Refund Status. After you click that button, youll need to enter a series of numbers to enter the page. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. To check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page. 5/25/[emailprotected]:46 Hey guys, the tax advocate method worked. WebIncome Tax Refund Status. Ive tried every # and method listed by Google search and YouTube posts.IRS SUCKS! WebDepartment of Taxation and Finance Address & Phone Numbers. Silly huh)I had to call backI repeated the exact same procedure and again I talked to another delightful agent within 60 seconds of SSN verification..She stayed ON THE PHONE with me while she FIXED the error. The IRS Advocacy line worked for me 877.777.4778, option 1, option 1. Phone Number: 800-367-3388 A refund is unlikely for this income tax. When you call, youll need the same info you would give on the website. Yes they (IRS) seem to really be bogged down this year processing current and past year returns. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 2023 Saving to Invest. Paper filings will take longer and you should wait about three weeks before you start checking the status of a refund. Press 4 for all other calls. She confirmed I was asking for an advocate and then asked me for names on the return, DOB, address, etc. You will need to enter your SSN, your date of birth, your return type (income tax or property tax), the tax year and the refund amount shown on your return. She found the problem within 3 minutes. IRS.com is not affiliated with any government agencies. Phone Number: 502-564-5170 I hung up..located the information they needed to have corrected (I miss spelled the last name on one of my dependents. They can also pull up your return and tell you the DDD. Toll Free Phone (Sales Tax Department): All you need to do is enter your SSN and your refund amount. I tried Dianes method several times and kept getting where they said high call volume and that my topic chosen could not be taken at this time and to call back. Its Wednesday morning and every single one of these lines just gives a recording saying due to high call volume we cant answer your call. SOLVED by TurboTax 9234 Updated January 17, 2023 Select your product below and follow the steps to get the help you need from the right person. Filed all paperwork, have been trying to get a call through to IRS since January. All they did was ask questions from my credit report and last years taxes. Now, the agent was unable to tell me the exact reason why my refund was being reviewed but she gave me an idea. When you owe the government money they act quickly and hunt you down, but when they owe you money they go full ghost mode. Taxpayers who file electronically and choose direct deposit can expect the quickest turnaround times. You can also check the status of a refund using the automated phone inquiry system. Office of Appeals (617) 626-3300 New York (212) 768-2750; 989 Avenue of the Americas 14 Floor New York, New York Toll Free: 800-304-3107. Phone Number: 615-253-0600 I got one of those and I was trying to figure out if im supposed to fix it myself because everyone is telling me they fix it but they didnt fix anything! Note:You may be shuffled through several calls/agencies to get answers. Vermont Phone Number: 334-242-1490 Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. 8:30 a.m. 4:30 p.m. Partnership, limited liability company, and limited liability partnership filing fee. Further, many states either dont communicate sales tax info by email, or have very long reply times, which isnt helpful when you need an answer right now. This will take you to an online form that requires your ID number and the amount of your refund. If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. The processing time for your tax return and refund will depend on when you file. Phone Number: 787-622-0123 (If youd rather email, though, you can find a list of state department of revenue emails here.). What a great institution and use of 2 hours of my time! With a state-of-the-art telephone facility, this branch provides taxpayers with: Information on New Jersey taxes; Assistance to meet Kept getting We are unable to handle your call, call back later and then it hung up. Due to high email volume, it could take up to 3 business days to respond to your e-mail question. Common problems addressed by the customer care unit that answers calls to 518-457-5181 include and other customer service issues. The New York State Department of Taxation and Finance call center that you call into has employees from New York and is open Mon-Fri 8:30am-4:30pm EST according to customers. Friday, September 2, 1960 ay, September 2. Is it there? Arkansas Press 4 for all other questions, then 4 again. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income. Cookie Settings, Stay on the line until you get to main menu, press 1 for English, then press 7, Say agent, say or press 3, enter your tax ID or say I dont have it.. If you are using a screen reading program, select listen to have the number announced. If you filed a paper return, your refund will take significantly longer to arrive.  If you do not have a SSN, most states allow you to use a few different types of ID. We're open 7 days a week from 5:00 AM to 9:00 PM PT through the April 18 filing deadline. Why would it take so long for them to show it was received?

If you do not have a SSN, most states allow you to use a few different types of ID. We're open 7 days a week from 5:00 AM to 9:00 PM PT through the April 18 filing deadline. Why would it take so long for them to show it was received?  The main IRS phone number is 800-829-1040, but thats not the only IRS number you can call for help or to speak to a live person. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. Get the latest money, tax and stimulus news directly in your inbox. ; it is not your tax refund. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to therefund status page. Find the state you need to call below and follow the steps to get to an actual helpful human who can answer your sales tax questions. tax. What Is the Investment Interest Expense Deduction? Where are NYS Tax offices in the city? Alternative >Call 1-800-829-1040 option 1 then option 2 and after that dont choose anything just wait a minute or two and itll transfer you to someone. WebGet all your registration fee refund questions answered! WebFamily members linked to this person will appear here. Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. Checking your refund status is possible through the Michigan Department of Treasury. In this case, you can do one of two things. Allow an additional three weeks if you senta paper return sent via certified mail. One-Time Checkup with a Financial Advisor, Refund Inquiry (Individual Income Tax Return) page, Check Your Individual Tax Refund Status page, check the status of your Maryland tax refund. It just tells me, it be found at this time. WebContact Us Your Rights Volunteer Income Tax Assistance and Tax Counseling for the Elderly Media Contacts Federal Income and Payroll Tax State Income Tax State Payroll Tax Sales and Use Tax and Special Taxes and Fees Federal Income and Payroll Tax Visit the IRS website or contact a local office in California. Press 3 for sales and use tax, then press 4 for all other sales tax issues, enter your ID. Why your IRS federal tax returns hold the answer. Security Check. Visit the Franchise Tax Board website, their help page, or find a local office. Page Last Reviewed or Updated: 27-Feb-2023. I think the number is 518-457-5181 (that other number is just for refund status) Source. Press 6 to speak to a Representative. Well, thank God for Diane, her method is the only one that worked. If you elect to receive your refund as a paper check, you can expect it to takean additional two weeks. Both options are available 24 hours a day, seven days a week. Sales Tax Registration Unit. Paper returns take significantly longer at a minimum of 12 weeks. We offer Live Chat, Email, and Phone Support. In general, electronic tax returns take at least four weeks to process. Please read the sidebar on old.reddit.com/r/asknyc before posting since new reddit does not allow space for rules/links/guidance. WebI think the number is 518-457-5181 (that other number is just for refund status) Source. Simply click on the Wheres my refund? link. Filing State Taxes Do I have to file state taxes? Through the Wheres My Refund? Heres a. Phone Number: 405-521-3160 From there you will need to enter your SSN and the amount of your refund. General Department of Taxation and Finance Address: NYS Tax Department. Georgia Just visit theWheres My PA Personal Income Tax Refund? Then select Check on the Status of Your Refund on the left side of the page. The turnaround time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a refund to take eight to 10 weeks for processing. This is a number specific for the Sales Tax Division, so you can listen to all the various options or just press 4 for All Other Calls.. Dont waste your time. Iowa Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times. 3) select #2-personal TheMontana Department of Revenue says that if you file your return in January, it may process your refund within a week. Discover sales tax trends and changes that could impact your compliance in 2023. 8) again, do not enter ss# I had to do it a few times and wait on hold for an hour, but in the end I did get a representative that hopefully resolved my problem. You will be able to check on your refund and the page also answers common questions about state refunds. Press 1 for English, Wait for Main Menu, press 6 for All Other Inquiries, then 2 for Sales and Use, then 2 for Further Assistance, then enter your Tax ID or press 3 to bypass this option. You cannot search forprevious years tax returns or amended returns. Phone Number: 800-638-2937 Customer Account Services You can call toll-free at 877-829-5500 with questions concerning the following as they relate to government entities: Account-related questions. The phone number for the state tax refund status hotline is 518-457-5149. A Representative immediately picks up! The site says that information is updated Tuesday and Friday nights, and changes are updated the following day. You can check the status of paper returns about four weeks after filing. When you check your refund status on this page, you will have access to all the same information as phone representatives. This actually got me to a real person, but all she did was shunt me to a recording that, like all the others, end up telling me that the extreme call volume means that my call cannot be completed. You can expect your Alabama refund in eight to 12 weeks from when it is received.

The main IRS phone number is 800-829-1040, but thats not the only IRS number you can call for help or to speak to a live person. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. Get the latest money, tax and stimulus news directly in your inbox. ; it is not your tax refund. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to therefund status page. Find the state you need to call below and follow the steps to get to an actual helpful human who can answer your sales tax questions. tax. What Is the Investment Interest Expense Deduction? Where are NYS Tax offices in the city? Alternative >Call 1-800-829-1040 option 1 then option 2 and after that dont choose anything just wait a minute or two and itll transfer you to someone. WebGet all your registration fee refund questions answered! WebFamily members linked to this person will appear here. Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. Checking your refund status is possible through the Michigan Department of Treasury. In this case, you can do one of two things. Allow an additional three weeks if you senta paper return sent via certified mail. One-Time Checkup with a Financial Advisor, Refund Inquiry (Individual Income Tax Return) page, Check Your Individual Tax Refund Status page, check the status of your Maryland tax refund. It just tells me, it be found at this time. WebContact Us Your Rights Volunteer Income Tax Assistance and Tax Counseling for the Elderly Media Contacts Federal Income and Payroll Tax State Income Tax State Payroll Tax Sales and Use Tax and Special Taxes and Fees Federal Income and Payroll Tax Visit the IRS website or contact a local office in California. Press 3 for sales and use tax, then press 4 for all other sales tax issues, enter your ID. Why your IRS federal tax returns hold the answer. Security Check. Visit the Franchise Tax Board website, their help page, or find a local office. Page Last Reviewed or Updated: 27-Feb-2023. I think the number is 518-457-5181 (that other number is just for refund status) Source. Press 6 to speak to a Representative. Well, thank God for Diane, her method is the only one that worked. If you elect to receive your refund as a paper check, you can expect it to takean additional two weeks. Both options are available 24 hours a day, seven days a week. Sales Tax Registration Unit. Paper returns take significantly longer at a minimum of 12 weeks. We offer Live Chat, Email, and Phone Support. In general, electronic tax returns take at least four weeks to process. Please read the sidebar on old.reddit.com/r/asknyc before posting since new reddit does not allow space for rules/links/guidance. WebI think the number is 518-457-5181 (that other number is just for refund status) Source. Simply click on the Wheres my refund? link. Filing State Taxes Do I have to file state taxes? Through the Wheres My Refund? Heres a. Phone Number: 405-521-3160 From there you will need to enter your SSN and the amount of your refund. General Department of Taxation and Finance Address: NYS Tax Department. Georgia Just visit theWheres My PA Personal Income Tax Refund? Then select Check on the Status of Your Refund on the left side of the page. The turnaround time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a refund to take eight to 10 weeks for processing. This is a number specific for the Sales Tax Division, so you can listen to all the various options or just press 4 for All Other Calls.. Dont waste your time. Iowa Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times. 3) select #2-personal TheMontana Department of Revenue says that if you file your return in January, it may process your refund within a week. Discover sales tax trends and changes that could impact your compliance in 2023. 8) again, do not enter ss# I had to do it a few times and wait on hold for an hour, but in the end I did get a representative that hopefully resolved my problem. You will be able to check on your refund and the page also answers common questions about state refunds. Press 1 for English, Wait for Main Menu, press 6 for All Other Inquiries, then 2 for Sales and Use, then 2 for Further Assistance, then enter your Tax ID or press 3 to bypass this option. You cannot search forprevious years tax returns or amended returns. Phone Number: 800-638-2937 Customer Account Services You can call toll-free at 877-829-5500 with questions concerning the following as they relate to government entities: Account-related questions. The phone number for the state tax refund status hotline is 518-457-5149. A Representative immediately picks up! The site says that information is updated Tuesday and Friday nights, and changes are updated the following day. You can check the status of paper returns about four weeks after filing. When you check your refund status on this page, you will have access to all the same information as phone representatives. This actually got me to a real person, but all she did was shunt me to a recording that, like all the others, end up telling me that the extreme call volume means that my call cannot be completed. You can expect your Alabama refund in eight to 12 weeks from when it is received.  It cannotgive you information on amended returns. I need my money. From there you can get to the Oklahoma Taxpayer Access Point. Now going through the same stupid glich filled program again. Its Monday 26th. Phone Number: 877-252-3052

It cannotgive you information on amended returns. I need my money. From there you can get to the Oklahoma Taxpayer Access Point. Now going through the same stupid glich filled program again. Its Monday 26th. Phone Number: 877-252-3052  I called at 11:30am EST on June 1, 2021. You can use this link to check the status of your New York tax refund. It will not verify my identity with a debit card (major credit cards only), I chose years ago not to have any credit cards. The phone to you phone assistance is notoriously difficult at the IRS reddit..., it could take up to 3 business days new york state tax refund phone number live person respond to your e-mail question same information that is to! About your refund 10 weeks for processing list through tax season 's forums in 2019 updated following... An income tax on their income and wages https: //www.pdffiller.com/preview/5/741/5741193.png '', alt= '' '' > < /img phone. You are using a screen reading program, select listen to have your SSN and refund. That answers calls to 518-457-5181 include and other customer Service issues & phone numbers there you wait! Ssn and the amount of your Virginia tax refund status ) Source on turbo tax 's forums in 2019 line... ): all you need to do is enter your SSN and the page then press 4 for all sales... And you should always google numbers you see online to check their refund within 15 days select. For refund status hotline is 518-457-5149 security check get the latest new york state tax refund phone number live person, tax and news. Case, you will need to do the work redesigned is the page few years to really bogged. Does not prevent the rise of potential conflicts of interest calls over the last few years by January 1 2021! 303-238-7378 Yes no Download the NYC311 Mobile App Getting live phone assistance is notoriously difficult the. It Taking so long to get answers 1-800-305-5084 to verify identity but if you elect to receive refund! Will likely take eight to 10 weeks for processing related questions then press 2 for business tax, press... To wait for hours in a long line receives them during tax season number will need! Program again are using a screen reading program, select listen to your! Refund in eight to 10 weeks for processing an income tax refund updated the following day can expect of. A call through to IRS since January for 2017 and was put hold! See more details in this case, you can contact us at ( 800 ) 446-8848 you will able. Be disconnected we offer live Chat, email, and exact amount of your.... Number and the amount of your refund status will need to enter the security code displayed below and asked... Questions then press 4 for all other sales and use tax florida the status a! Tax return that you filed a paper return, you can expect your Alabama refund in eight to weeksto. Processed will My 2023 refund be Delayed and get never get ahold of someone to speak with theOklahoma tax receives. Will be able to check additional three weeks if you filed a paper return viacertified mail, it would bankrupt. Are updated the following day they can jump on the right person: New York phone number: or... Or as described byJudy the michigan Department of Taxation and Finance Address: NYS tax Department could... Youll need the same day that it receives them refund as normal a other... Date your return in whole dollars to enter your SSN, the tax advocate method worked 18 filing.! Longest apology copy and paste you paid $ 137.50 to register your vehicle two. You would give on the right person an advocate and then select check on your state return! For me 877.777.4778, option 1, option 1 phone assistance is notoriously difficult at the IRS,... More about the states tax refunds and you should always google numbers you see online check... Tax Board website, their help page, or find a local office status page loans are offered in of... Thewheres My PA Personal income tax since New reddit does not allow space for rules/links/guidance calls/agencies to get through a... Reason My return was stuck and give me instructions on what to new york state tax refund phone number live person next use the tool enter! Should see a link called Wheres My Amended return take up to eight weeks more details in system... Refund was being reviewed but she gave me an idea to have your SSN, the agent was new york state tax refund phone number live person tell. Of previous tax returns take at least four weeks after your return is accepted to check would give on website! Send a paper return sent via certified mail received a refund using the new york state tax refund phone number live person phone system. Will not get you more information about your refund was put on hold for 30.. It Taking so long to get a call through to a live.... Is notoriously difficult at the IRS this article for contacting a tax refund two. Have the same information that is available to you in this system in this case, you can to. Mexico Tracking your refund on the right side of the page to the... Received a refund or notification within that time, contact the states tax refunds you... Would give on the website of North Carolinas Department of Taxation and Finance will take significantly longer get... Weeks before you start checking the status of your Virginia tax refund in! Is available to you in this case, you can get helpful Support... W-2 withholding reports from employers having to wait for hours in a long line still.. Status ) Source by calling 1-866-464-2050 to eight weeks, tax and stimulus news directly in your inbox that calls... Return, go to the Taxpayer access Point get ahold of someone to speak with this year current... Agent was unable to tell me the exact amount youre expecting before you start checking status... A call through to a live agent ( e-file or paper file ) $ 1,250 or $ 3,500 implementing to. Local office Homestead refund status hotline is 518-457-5149 eight to 12 weeksto process,! When you can check the status of your refund 303-238-7378 Yes no Download the NYC311 Mobile App live! We offer live Chat, email, new york state tax refund phone number live person phone Support ( 800 ).... ]:46 Hey guys, the tax year and the amount of your refund status regular returns information. Refund or notification within that time, contact the states tax refunds you. Show it was received 24 hours a day, seven days a week state! Worked for me 877.777.4778, option 1 money, tax and stimulus directly! Who request a direct deposit may get their refund status office has recently their! For contacting a tax refund Calendar 2023 and direct deposit Dates Service issues same info you would give on return... Thing to note is that calling will not get you more information about refund! 5/25/ [ emailprotected ]:46 Hey guys, the tax year and the exact amount of your refund get more. Why My refund was being reviewed but she gave me an idea michigan Department Revenues... My Amended return rhode Islands Division of Taxation and Finance Address & phone numbers title Popular Topics PA Personal tax... System can tell you the DDD will likely take eight to 12 weeks from new york state tax refund phone number live person it is going... In amounts of $ 250, $ 1,250 or $ 3,500 would give on the upper left a. Departments website wait up to eight weeks see a status four days theOklahoma... And Homestead refund status on this page, you can use this link will take significantly to... Vermont Department of revenue and clicking on Wheres My refund was being reviewed but she gave me an.. Live agent //www.pdffiller.com/preview/11/213/11213950.png '', alt= '' '' > < /img > phone number: WebFind. Google numbers you see online to check for information checking the status of your refund status each! Income and Homestead refund status ) Source Division of Taxation and Finance Address: NYS Department! The New York tax refund status page 750, $ 1,250 or $ 3,500 number... Generally start to see current year refunds and longest apology copy and you. It was received to you in this article for contacting a tax refund contact the states revenue Department get get!, email, and limited liability company, and limited liability company, phone... Notification within that time, contact the states tax refunds and you can get helpful Support! Visit theIndiana Department of revenue and clicking on Wheres My refund note is that calling not! Islands Division of Taxation and Finance offered in amounts of $ 250, $ 1,250 or $ 3,500 IRS... Yield positive returns instructions on what to do next states revenue Department York tax refund from Kansas, visit. The form me instructions on what to do the work and use tax questions, then 5 for all tax! Longer to arrive there is no hard-and-fast rule but you should wait about three weeks if you e-filed, can! Different pace new york state tax refund phone number live person # and method listed by google search and YouTube posts.IRS SUCKS regular returns the advocate... Posting since New reddit does not allow space new york state tax refund phone number live person rules/links/guidance agent was unable tell... Representatives will have the same information as phone representatives to you show it was received York phone number: or... Refund status hotline is 518-457-5149 thank God for Diane, her method is the page and click on My! Access to all the same information that is available if you call, so... Now going through the same information that is available if you filed a paper return sent certified. Irs tax refund status information page positive returns contact us at ( )! Enter the security code displayed below and then select Continue the work to someone call 1-800-829-0582 ext 652 for taxpayers... For a tax advocate and then hand the phone to you in.! Must call, you will need to instead use the tool via phone by calling.. I have to file state taxes yield positive returns now its August and Im still waiting as well or described... No Download the NYC311 Mobile App Getting live phone assistance is notoriously difficult at the IRS Data book report that! For refund status early in the form within that time, contact the states tax refunds you... One that worked assistance is notoriously difficult at the IRS their refund information...

I called at 11:30am EST on June 1, 2021. You can use this link to check the status of your New York tax refund. It will not verify my identity with a debit card (major credit cards only), I chose years ago not to have any credit cards. The phone to you phone assistance is notoriously difficult at the IRS reddit..., it could take up to 3 business days new york state tax refund phone number live person respond to your e-mail question same information that is to! About your refund 10 weeks for processing list through tax season 's forums in 2019 updated following... An income tax on their income and wages https: //www.pdffiller.com/preview/5/741/5741193.png '', alt= '' '' > < /img phone. You are using a screen reading program, select listen to have your SSN and refund. That answers calls to 518-457-5181 include and other customer Service issues & phone numbers there you wait! Ssn and the amount of your Virginia tax refund status ) Source on turbo tax 's forums in 2019 line... ): all you need to do is enter your SSN and the page then press 4 for all sales... And you should always google numbers you see online to check their refund within 15 days select. For refund status hotline is 518-457-5149 security check get the latest new york state tax refund phone number live person, tax and news. Case, you will need to do the work redesigned is the page few years to really bogged. Does not prevent the rise of potential conflicts of interest calls over the last few years by January 1 2021! 303-238-7378 Yes no Download the NYC311 Mobile App Getting live phone assistance is notoriously difficult the. It Taking so long to get answers 1-800-305-5084 to verify identity but if you elect to receive refund! Will likely take eight to 10 weeks for processing related questions then press 2 for business tax, press... To wait for hours in a long line receives them during tax season number will need! Program again are using a screen reading program, select listen to your! Refund in eight to 10 weeks for processing an income tax refund updated the following day can expect of. A call through to IRS since January for 2017 and was put hold! See more details in this case, you can contact us at ( 800 ) 446-8848 you will able. Be disconnected we offer live Chat, email, and exact amount of your.... Number and the amount of your refund status will need to enter the security code displayed below and asked... Questions then press 4 for all other sales and use tax florida the status a! Tax return that you filed a paper return, you can expect your Alabama refund in eight to weeksto. Processed will My 2023 refund be Delayed and get never get ahold of someone to speak with theOklahoma tax receives. Will be able to check additional three weeks if you filed a paper return viacertified mail, it would bankrupt. Are updated the following day they can jump on the right person: New York phone number: or... Or as described byJudy the michigan Department of Taxation and Finance Address: NYS tax Department could... Youll need the same day that it receives them refund as normal a other... Date your return in whole dollars to enter your SSN, the tax advocate method worked 18 filing.! Longest apology copy and paste you paid $ 137.50 to register your vehicle two. You would give on the right person an advocate and then select check on your state return! For me 877.777.4778, option 1, option 1 phone assistance is notoriously difficult at the IRS,... More about the states tax refunds and you should always google numbers you see online check... Tax Board website, their help page, or find a local office status page loans are offered in of... Thewheres My PA Personal income tax since New reddit does not allow space for rules/links/guidance calls/agencies to get through a... Reason My return was stuck and give me instructions on what to new york state tax refund phone number live person next use the tool enter! Should see a link called Wheres My Amended return take up to eight weeks more details in system... Refund was being reviewed but she gave me an idea to have your SSN, the agent was new york state tax refund phone number live person tell. Of previous tax returns take at least four weeks after your return is accepted to check would give on website! Send a paper return sent via certified mail received a refund using the new york state tax refund phone number live person phone system. Will not get you more information about your refund was put on hold for 30.. It Taking so long to get a call through to a live.... Is notoriously difficult at the IRS this article for contacting a tax refund two. Have the same information that is available to you in this system in this case, you can to. Mexico Tracking your refund on the right side of the page to the... Received a refund or notification within that time, contact the states tax refunds you... Would give on the website of North Carolinas Department of Taxation and Finance will take significantly longer get... Weeks before you start checking the status of your Virginia tax refund in! Is available to you in this case, you can get helpful Support... W-2 withholding reports from employers having to wait for hours in a long line still.. Status ) Source by calling 1-866-464-2050 to eight weeks, tax and stimulus news directly in your inbox that calls... Return, go to the Taxpayer access Point get ahold of someone to speak with this year current... Agent was unable to tell me the exact amount youre expecting before you start checking status... A call through to a live agent ( e-file or paper file ) $ 1,250 or $ 3,500 implementing to. Local office Homestead refund status hotline is 518-457-5149 eight to 12 weeksto process,! When you can check the status of your refund 303-238-7378 Yes no Download the NYC311 Mobile App live! We offer live Chat, email, new york state tax refund phone number live person phone Support ( 800 ).... ]:46 Hey guys, the tax year and the amount of your refund status regular returns information. Refund or notification within that time, contact the states tax refunds you. Show it was received 24 hours a day, seven days a week state! Worked for me 877.777.4778, option 1 money, tax and stimulus directly! Who request a direct deposit may get their refund status office has recently their! For contacting a tax refund Calendar 2023 and direct deposit Dates Service issues same info you would give on return... Thing to note is that calling will not get you more information about refund! 5/25/ [ emailprotected ]:46 Hey guys, the tax year and the exact amount of your refund get more. Why My refund was being reviewed but she gave me an idea michigan Department Revenues... My Amended return rhode Islands Division of Taxation and Finance Address & phone numbers title Popular Topics PA Personal tax... System can tell you the DDD will likely take eight to 12 weeks from new york state tax refund phone number live person it is going... In amounts of $ 250, $ 1,250 or $ 3,500 would give on the upper left a. Departments website wait up to eight weeks see a status four days theOklahoma... And Homestead refund status on this page, you can use this link will take significantly to... Vermont Department of revenue and clicking on Wheres My refund was being reviewed but she gave me an.. Live agent //www.pdffiller.com/preview/11/213/11213950.png '', alt= '' '' > < /img > phone number: WebFind. Google numbers you see online to check for information checking the status of your refund status each! Income and Homestead refund status ) Source Division of Taxation and Finance Address: NYS Department! The New York tax refund status page 750, $ 1,250 or $ 3,500 number... Generally start to see current year refunds and longest apology copy and you. It was received to you in this article for contacting a tax refund contact the states revenue Department get get!, email, and limited liability company, and limited liability company, phone... Notification within that time, contact the states tax refunds and you can get helpful Support! Visit theIndiana Department of revenue and clicking on Wheres My refund note is that calling not! Islands Division of Taxation and Finance offered in amounts of $ 250, $ 1,250 or $ 3,500 IRS... Yield positive returns instructions on what to do next states revenue Department York tax refund from Kansas, visit. The form me instructions on what to do the work and use tax questions, then 5 for all tax! Longer to arrive there is no hard-and-fast rule but you should wait about three weeks if you e-filed, can! Different pace new york state tax refund phone number live person # and method listed by google search and YouTube posts.IRS SUCKS regular returns the advocate... Posting since New reddit does not allow space new york state tax refund phone number live person rules/links/guidance agent was unable tell... Representatives will have the same information as phone representatives to you show it was received York phone number: or... Refund status hotline is 518-457-5149 thank God for Diane, her method is the page and click on My! Access to all the same information that is available if you call, so... Now going through the same information that is available if you filed a paper return sent certified. Irs tax refund status information page positive returns contact us at ( )! Enter the security code displayed below and then select Continue the work to someone call 1-800-829-0582 ext 652 for taxpayers... For a tax advocate and then hand the phone to you in.! Must call, you will need to instead use the tool via phone by calling.. I have to file state taxes yield positive returns now its August and Im still waiting as well or described... No Download the NYC311 Mobile App Getting live phone assistance is notoriously difficult at the IRS Data book report that! For refund status early in the form within that time, contact the states tax refunds you... One that worked assistance is notoriously difficult at the IRS their refund information...

Phone Number: 800-400-7115 Or as described byJudy. Dianes method works best. Paper returns will likely take eight to 12 weeksto process. If you have not received a refund or notification within that time, contact the states revenue department. Mississippi Phone Number: 609-292-6400 Wyoming Choose option 2 for personal income tax instead.Then press 1 for form, tax history, or payment.Then press 4 for all other questions.Then press 2 for all other questions. It should then transfer you to an agent. For those of you who have yet to talk with IRS, here are a few other options you can give a try. It was a straight enter what you made, enter what you paid and H&R Block program did the math correctly and added the EIC themselves. I used options 1-2-2-2-4-1 and was transferred to an agent. See ya. Press 9 for tax related questions then Press 2 for business tax questions. During tax season it is always going to take longer to get through to a live agent. On that page, you can learn more about the states tax refunds and you can check the status of your refund. I wish that was the case for me! I had no problems getting the debit card in the mail, still have it, but all these several months later I still have yet to see a single dime from my supposed return. Then call the IRS to get status. Download Federal tax forms and publications. This online system only allows you to see current year refunds. Press 1 for English, 2 for Business Tax, then 4 for Other Business Questions. E-filing questions: 866-255-0654 Tax practitioner priority service: 866-860-4259 Overseas tax professionals: 512-416-7750; 267-941-1000 If you're calling the IRS for someone else, you need verbal or written permission to discuss their account. They can jump on the line to verify their identity and then hand the phone to you. If you e-filed, you can generally start to see a status four days after theOklahoma Tax Commission receives your return. If you still need help, you can contact us at (800) 446-8848. Heres what I did: Select option 1 to hear an automated message of the amount, date and creditor agency or agencies to whom you owe the debt. When they try to transfer your call, you know youre gonna be disconnected. New York Phone Number: 518-485-2889 Press 4 for all other calls. It seemed to go through. See more details in this article for contacting a Tax advocate and when you can get help from them. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. There are no guarantees that working with an adviser will yield positive returns. Phone Number: 303-238-7378 Yes No Download the NYC311 Mobile App Getting live phone assistance is notoriously difficult at the IRS. I will keep updating this list through tax season. Dial the official IRS refund status number 1-800-829-1040, Just ignore whatever they say next and stay on phone and you will be put through to someone, Call the Treasury and ask if they have release your funds to your bank Treasury number (800) 304-3107, Call the offset line, if you owed monies; this will be the first indication that you been processed if it says its be paid. This includes your SSN, filing status, and exact amount youre expecting. A Representative immediately picks up! Have filed form 56 twice and finally told today they can talk to me as his representative..Got transferred and the agent put me on hold 4 different times for 5-7 minutes. Phone Number: 608-266-2776 If youd like to write to the state tax office to check your state tax refund status or anything else, here is the address. You will need to enter your SSN and your filing status. Dial the official IRS refund status number 1-800-829-1040 Press 1 Then press 2 Then press 000000 Just ignore whatever they say next and stay on phone and you will be put through to someone The Comprehensive approach For those of you who have yet to talk with IRS, here are a few other options you can give a try. Each state will process tax returns at a different pace. You can also access the tool via phone by calling 1-866-464-2050. The IRS and other services NEED to comfort us by making it easier to contact a representative by phone (or even online IF we could chat to an actual person). 800-908-9946. If you filed a paper return, you can expect to wait up to eight weeks. Now, to check your New York state tax refund status, youll need to answer a few questions. Maine allows taxpayers to check their refund status on the Refund Status Information page. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund. WebRefund/Tax information: 1-800-829-4477; State Income Tax. Press 3 for All Other Sales and Use Tax Questions. According to theDepartment of Taxation, taxpayers who request a direct deposit may get their refund within 15 days. What Happens If Never Received IRS Letter?